July Pork Exports Continue Above Year-Ago; Slow Month for Beef Exports

Building on a robust first-half performance, July exports of U.S. pork continued to outpace year-ago levels, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports took a step back in July, posting the lowest volume since January, but export value per head of fed slaughter again exceeded $400.

July pork exports totaled 219,014 metric tons (mt), up 5% year-over-year, while export value increased 1% to $628.7 million. Through the first seven months of 2023, pork exports were 13% above last year’s pace at 1.69 million mt, valued at $4.67 billion (up 10%).

“Market diversification has been the top priority for the U.S. pork industry and those efforts are certainly reflected again in these results,” said USMEF President and CEO Dan Halstrom. “In July, exports trended lower to China/Hong Kong, Japan and South Korea, but our Western Hemisphere markets and other destinations in the Asia-Pacific continued to shine. This is exactly the type of broad international footprint the industry needs to maintain consistent export growth.”

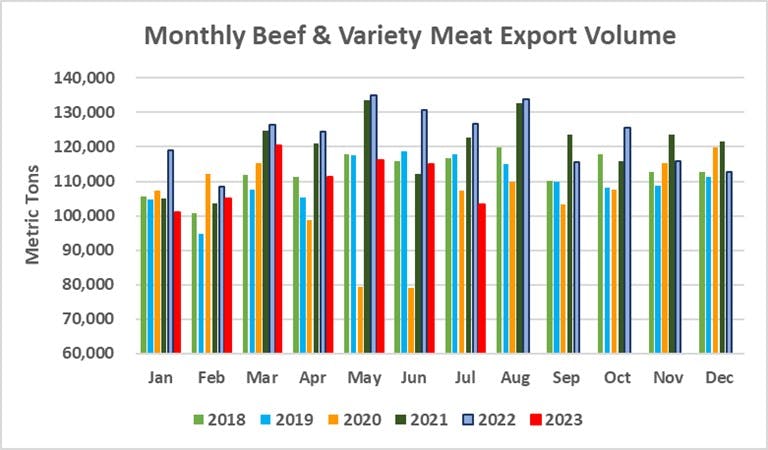

July beef exports totaled 103,167 mt, down 18% from a year ago and the lowest in six months. Export value was $810.4 million, down 19% and the lowest since February. For January through July, beef exports trailed last year’s record pace by 11% in volume (772,343 mt) and 19% in value ($5.81 billion).

“It’s definitely a challenging environment on the beef side, due in part to limited supplies but also persistent headwinds in our key Asian markets,” Halstrom explained. “Though it’s taking longer than anticipated, we still expect a broader foodservice rebound in Asia. And some bright spots for U.S. beef include sustained demand in Taiwan, especially for alternative beef cuts, and the continued momentum in Mexico. It’s also encouraging to see per-head export value maintaining a high level. This is an important metric for gauging the returns delivered by the international markets, even when our production is trending lower.”

Western Hemisphere markets bolster July pork exports

Pork exports to leading market Mexico continue to far exceed last year’s record pace, with July shipments up 15% from a year ago to 81,081 mt. July export value increased 12% to $189.4 million. January-July exports to Mexico increased 14% from a year ago to 614,015 mt, while value soared 20% to $1.26 billion. This included a surge in pork variety meat exports, which increased 47% to 90,311 mt, valued at $160.6 million (up 43%).

July was another strong month for pork exports to Central America, which increased 23% from a year ago to 9,138 mt, valued at $27.3 million (up 26%). January-July shipments to the region were up 6% to 70,828 mt, while value climbed 12% to $203.2 million. Growth was fueled by strong demand in Guatemala, El Salvador, Honduras, Costa Rica and Nicaragua.

Taiwan’s demand for U.S. pork continues to make an impressive rebound in 2023. July exports to Taiwan were 2,388 mt, up from just 352 mt a year ago. July value reached $7.8 million, up from just $880,000. January-July exports were the largest since 2013, increasing 539% from a year ago to 12,668 mt, while value climbed 627% to $41.3 million. This year’s exports to Taiwan already exceed the combined results from calendar years 2021 and 2002, which totaled only 9,500 mt valued at $29 million.

Other January-July export results for U.S. pork include:

Although pork exports to South Korea trended lower in July, shipments through the first seven months of the year still increased 6% to 113,756 mt. Export value declined slightly, falling 1% to $370.6 million. In recent months, Korea has implemented duty-free quotas for imported pork as part of its effort to combat food price inflation. These quotas mainly benefit Canadian, Mexican and Brazilian pork, as imports from the U.S., European Union and Chile already enter at zero duty under free trade agreements with Korea.

Pork exports to China/Hong Kong, which are currently primarily variety meat, were also lower in July but remain well ahead of last year’s pace. January-July shipments totaled 315,539 mt, up 18% year-over-year, valued at $813.6 million (up 14%).

In Japan, July pork exports were down 12% from a year ago to 25,357 mt, while value fell 9% to $106. 9 million. This pushed January-July shipments 3% below last year’s pace at 212,626 mt, valued at $856.3 million (down 6%).

July pork exports to Canada increased 15% from a year ago to 16,615 mt, valued at $67 million (up 2%). Through July, exports to Canada were 11% above last year at 119,341 mt, though value fell 1% to $472.2 million.

Fueled by solid growth in the Philippines and Vietnam and surging demand from Malaysia, pork exports to the ASEAN region reached 43,689 mt through July, up 51% from a year ago, while value increased 26% to $103.5 million. Domestic production in the Philippines and Malaysia continues to be impacted by African swine fever. Opportunities for U.S. exporters have also increased due to tighter supplies of European pork.

Demand for U.S. pork has rebounded dramatically in both Australia and New Zealand, pushing January-July exports to 45,173 mt, up 74% from a year ago. Export value increased 64% to $159.1 million. While market access is limited, fresh/frozen U.S. pork may be imported for further processing and the region has a growing appetite for value-added processed U.S. pork products.

Exports to the Dominican Republic are on a record pace through July, totaling 60,518 mt (up 26% from a year ago) valued at $163.4 million (up 34%). Brazil was recently granted access for a few pork establishments, adding to competition from the United Kingdom, Canada and the European Union. However, the U.S. is the DR’s dominant pork supplier and the only one with zero-duty access through a free trade agreement.

In addition to the growth achieved in Mexico (see above), July exports of pork variety meat also increased year-over-year to the ASEAN, Canada, Korea, Central America and the Caribbean. This offset a decline to leading market China, though January-July exports to China are still on a record pace. July variety meat exports were up 6% to 48,057 mt, valued at $108.9 million (up 4%). January-July shipments established a record pace, totaling 345,070 mt, up 28% from a year ago, valued at $812.7 million (up 19%).

July pork export value equated to $65.38 per head slaughtered, down 3% from a year ago, while the January-July average increased 8% to $64.07. Exports accounted for 30.3% of total July pork production, up one percentage point from a year ago. For muscle cuts only, exports accounted for 25.5% of production, up from 24.7%. For January through July, these ratios were 29.9% of total production and 25.6% for muscle cuts, up from 26.8% and 23.6%, respectively, a year ago.

July beef exports climb to Mexico and Taiwan but most markets trend lower

Beef exports to Mexico continued to gain momentum in July, climbing 31% from a year ago to 17,663 mt. Export value soared 55% in July, reaching $105.1 million. Through the first seven months of the year, exports to Mexico increased 17% to 117,834 mt, valued at $662.6 million (up 24%). Mexico is the leading volume destination for beef variety meat, and those exports have increased at a similar pace – up 18% in volume (61,762 mt) and 24% in value ($175.2 million).

After a slow start in 2023, beef exports to Taiwan have exceeded year-ago levels in three consecutive months. July exports to Taiwan climbed 15% to 5,298 mt, while value increased 2% to $52.2 million. Through July, exports to Taiwan remained 7% below last year’s record pace at 39,090 mt, valued at $379.8 million (down 23%).

Beef exports to Canada posted another strong month in July, with shipments climbing 12% from a year ago to 9,969 mt, valued at $87.2 million (up 17%). January-July exports to Canada increased 2% in both volume (61,933 mt) and value ($504.8 million).

Other January-July export results for U.S. beef include:

Beef exports to leading market South Korea slumped in July, down 24% from a year ago and the lowest volume since June 2020. Export value was $155.1 million, down 22% and the lowest since February. In addition to inflationary pressure affecting Korean consumers, transportation and economic activity was significantly impacted by heavy rain and flooding in some areas of Korea in mid-July (and again in early August). For January through July, exports to Korea totaled 151,095 mt, down 13% from last year’s record pace, valued at $1.24 billion (down 28%). On a positive note, beef variety meat exports to Korea have increased sharply this year in both volume (8,818 mt, up 65%) and value ($47.7 million, up 72%).

July beef exports to Japan also declined significantly, down 37% from a year ago to 19,350, valued at $150.3 million, down 35%. For January through July, exports were down 20% to 148,394 mt, valued at $1.07 billion (down 28%). While Japan remains the leading value market for U.S. beef variety meat (primarily tongues and skirts), January-July exports fell 22% to 26,123 mt, valued at $253.6 million (down 25%).

Beef exports to China were also down significantly from last year’s record pace, with January-July shipments falling 20% to 114,967 mt, valued at $964.2 million (down 25%). But with a post-COVID return in business travel and tourism, exports to neighboring Hong Kong have rebounded this year, increasing 23% to 22,906 mt, valued at $233.8 million (up 5%).

Led by growth in Cote D’Ivoire, July beef exports to Africa increased 25% from a year ago to 1,435 mt, though export value trended lower ($1.6 million, down 16%). Through July, exports to Africa – which are almost entirely beef variety meat – increased 67% to 14,199 mt, with value up 29% to $16.1 million. Exports trended higher to South Africa and Cote D’Ivoire.

Beef exports to the Dominican Republic increased slightly in July to 750 mt, valued at $8.4 million. January-July exports to the DR were 5% above last year’s record pace at 5,644 mt, valued at $61.4 million (up 9%). Similar to pork, the DR recently granted access to beef imported from some regions of Brazil. To date, following announced plant approvals, only small volumes of Brazilian beef offal have been reported. This change will heighten competition in the DR, but U.S. beef enjoys duty-free access while Brazilian beef will be subject to a 20% tariff.

While beef exports to Central America have trended lower in 2023, Honduras has decidedly bucked this trend. July shipments to Honduras totaled 226 mt, up from just 95 mt last year, while export value nearly doubled to $1.2 million. January-July exports to Honduras increased 23% to 1,752 mt, while value climbed 40% to $9 million – a record pace for both volume and value.

Beef exports to Peru jumped 83% from a year ago in July, reaching 1,082 mt, while value increased 78% to $3.7 million. Exports through July were up 38% to 4,495 mt, making Peru this year’s largest South American destination for U.S. beef, with about three-fourths of the volume being variety meat. Export value increased 15% to $19.3 million.

July beef export value equated to $403.63 per head of fed slaughter, down 15% from a year ago. The January-July average was $395.65, down 17%. Exports accounted for 14.2% of total July beef production and 11.8% for muscle cuts only, down significantly from the very high ratios (16.4% and 14.1%, respectively) posted a year ago. For January through July, exports accounted for 14.4% of total production and 12.1% for muscle cuts, compared to 15.5% and 13.3%, respectively, last year.

Lamb export volume rebounds in July

Following a slow second quarter, July exports of U.S. lamb muscle cuts showed signs of a rebound. July export volume was 197 mt, up 22% from a year ago and the highest since March. Export value was $928,000, down 2% year-over-year but the highest since April.

For January through July, lamb exports were 1% below last year’s pace at 1,264 mt, while value fell 6% to $7.3 million. Markets trending higher included Mexico, Canada, the Netherlands Antilles, Panama and Guatemala.

Complete January-July export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).