Impasse with China Weighs Heavily on May Exports of U.S. Red Meat

Exports of U.S. pork and beef trended lower in May, due primarily to steep declines in shipments to China, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). May exports of U.S. lamb cuts increased year-over-year, driven mainly by growing demand in Mexico.

In April and the first half of May, China’s total tariff rate on U.S. pork peaked at 172%, while the rate for U.S. beef was 147%. Even following a May 14 joint announcement temporarily easing tariffs for 90 days, China’s rates still stand at 57% for U.S. pork and 32% for U.S. beef. In addition, most U.S. beef production is ineligible due to China’s failure – since February – to renew expiring beef plant and cold storage facility registrations.

“The situation with China obviously had a severe impact on May exports, underscoring the importance of diversification and further development of alternative markets,” said USMEF President and CEO Dan Halstrom. “The need for progress in the U.S.-China trade negotiations is extremely urgent because tariffs could soar again on Aug. 12. This deadline is already impacting exporters’ decisions about whether to continue producing for the Chinese market. On the bright side, amid all this uncertainty, demand for U.S. red meat remains robust in many key regions.”

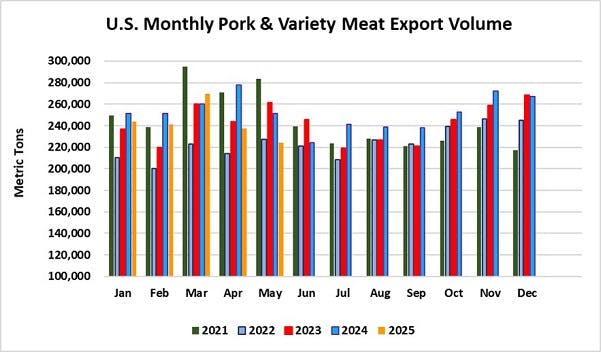

May pork exports totaled 224,162 metric tons (mt), down 11% from a year ago, while value fell 10% to $646.5 million. These were the lowest monthly totals since September 2023. Through the first five months of the year, exports were down 6% in volume (1.22 million mt) and 5% in value ($3.43 billion) compared to the record pace of 2024.

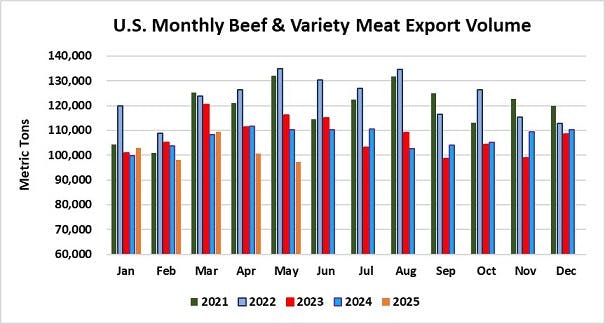

Beef exports totaled 97,266 mt in May, down 12% and the lowest in nearly five years. Export value was $798.7 million, down 11.5% and the lowest in 18 months. January-May beef exports were down 5% from last year’s pace at 508,293 mt, while value declined 3% to $4.15 billion.

Pork exports lower overall, but Latin American markets shined in May

Pork exports to leading market Mexico performed well in May, climbing 7% from a year ago to 97,697 mt. Export value was also up 7% to $216 million, the highest since January. These results pushed January-May exports to Mexico to 483,541 mt, up 1% from last year’s record pace, while export value increased 3% to $1.05 billion.

Demand for U.S. pork continues to thrive in Mexico, even as competition in the market heightens. While Mexico has not imposed any retaliatory measures against U.S. products, the potential for retaliation is looming as a 21% antidumping duty on tomatoes imported from Mexico is set to take effect July 14. Mexico has not published a retaliation list, but President Claudia Sheinbaum has identified U.S. pork as a possible target.

Outstanding growth in Honduras, Guatemala and Costa Rica pushed May pork exports to Central America to 14,764 mt, up 26% from a year ago, while value also soared 26% to $47.7 million. Shipments to the region are poised to shatter last year’s record, with January-May exports up 18% in volume (75,575 mt) and 21% in value ($238.8 million).

Pork exports to Colombia continued to gain momentum in May, climbing 31% to 12,627 mt. This was the fifth largest monthly export volume to Colombia and the third consecutive month exports have exceeded 12,000 mt. May export value increased 32% to just over $35 million. January-May shipments to Colombia are also on pace to top last year’s record, climbing 18% in volume (57,970 mt) and 23% in value ($165.8 million).

Other January-May results for U.S. pork exports include:

Pork exports to China, which are mainly variety meat, dropped to just 6,720 mt in May, down 82% from a year ago, while value fell 77% to $20.7 million. Through May, exports to China were down 22% from a year ago to 148,304 mt, valued at $363 million (down 18%). This trend is not likely to improve until tariff rates stabilize at more reasonable and predictable levels and exporters regain confidence in the long-term business climate in China.

Fueled by continued growth in Cuba, May pork exports to the Caribbean reached 11,263 mt, up 6% from a year ago, while value climbed 12% to $32.3 million. Shipments to Cuba more than tripled year-over-year to a record 1,760 mt, valued at just over $5 million (up 261%). May exports to the Dominican Republic were up slightly from a year ago in both volume (7,845 mt) and value ($21.6 million). For January through May, exports to the Caribbean increased 2% from a year ago in value to $161.3 million, despite a 4% decline in volume (53,068 mt). Cuba has been the main source of growth, with exports climbing 131% to 6,589 mt, valued at $19.7 million (up 141%). Exports also increased year-over-year to the Bahamas.

After a slow start to the year, pork exports to Japan have posted a modest rebound in recent months. May shipments to Japan totaled 30,104 mt, up slightly from a year ago, while value was down 4% to $117 million. January-May exports to Japan were 11% below last year’s pace at 135,962 mt, while value was down 13% to $540.2 million.

May pork exports to South Korea totaled 20,323 mt, down 10% from a year ago, while value fell 17% to $65.6 million. For January through May, exports to Korea were 13% below last year’s pace at 102,491 mt, with value down 16% to $331.4 million. Korea’s overall imports are also below last year’s high levels. This is due in part to a first-quarter slump for the Korean won, which has begun to regain strength versus the U.S. dollar since Korea’s political situation stabilized with the election of a new president.

May pork export value equated to $62.18 per head slaughtered, down 8% from a year ago. Exports to China accounted for less than $2, compared to about $8.50 in May 2024. The January-May average was $64.32, down 3% from the same period last year. Exports accounted for 27.8% of total May pork production, down significantly from the year-ago ratio of 30.7%. The percentage of muscle cuts exported was also down, but not as severely: 25.9% compared to 26.5% a year ago. For January through May, exports accounted for 29.3% of total pork production, down from 30.7% a year ago. For muscle cuts, the percentage of production exported was down one-half percentage point to 26%.

May beef exports to Korea largest in more than two years

U.S. beef posted an excellent May performance in leading market South Korea, with exports climbing 40% from a year ago to 25,228 mt, the largest since March 2023. Export value reached $233 million – up 39% and the highest since June 2022. These results pushed January-May exports to 106,867 mt, up 10% from the same period last year, with value up 12% to $1.02 billion.

Reinforcing and expanding demand in Korea is especially critical in light of the obstacles in China, particularly for cuts that command a premium in the Asian markets. More details about heightened efforts to move more U.S. beef short plate in Korea’s retail sector can be found here.

While May beef shipments to Central America increased modestly in volume (2,045 mt, up 4% year-over-year), value soared an impressive 36% to $18.5 million. Through May, exports to the region are on a record pace at 10,716 mt, up 8% from a year ago, while value climbed 31% to $81.2 million, driven by record shipments to top market Guatemala and strong growth in Costa Rica and Panama. While a surge in tourism – especially in El Salvador and Guatemala – is bolstering Central America’s demand for U.S. beef, local consumers are also seeking higher quality beef cuts at both foodservice and retail.

South America followed a similar trend as growth in Chile and Peru pushed May beef exports to 1,446 mt, up 3% from a year ago, while value climbed 21% to $32.3 million. For January through May, beef exports to South America jumped 29% in value to $56.4 million, despite a 2% decline in volume (7,770 mt). Shipments to Colombia are gradually rebounding from last year’s interruption due to restrictions related to highly pathogenic avian influenza in dairy cows. But the recovery is still a work in progress as Canada remains Colombia’s largest beef supplier, a milestone attained while U.S. access was restricted. For January through May, U.S. exports to Colombia were down 30% in volume (1,501 mt), but value increased 4% to $13.5 million.

Other January-May results for U.S. beef exports include:

Due to both high tariffs and lack of eligible plants, May beef exports to China plunged to just 1,398 mt, down 91% from a year ago. Export value was $14.6 million, down 90%. Despite a relatively strong first quarter, January-May exports to China fell 31% to 51,418 mt, valued at $449.3 million (down 32%). As noted above, U.S. beef is currently subject to a 32% tariff in China, but expired plant registrations are an even more daunting obstacle, effectively closing the market. Even the few exporters still eligible to ship to China face tremendous uncertainty, with the possibility of rising retaliatory duties looming in August.

Beef exports to Japan saw mixed results in May, with volume up 4% to 21,791 mt, while value fell 5% to $156 million. Through the first five months of the year, exports to Japan were slightly below last year’s pace at 104,012 mt (down 1%), while value was down 3% to $773 million. While Japan has not imposed any countermeasures on U.S. exports, it has been one of the trading partners most impacted by U.S. tariffs on autos, steel and aluminum. Japan’s tariff rate on U.S. chilled and frozen beef remains high at 21.6%, but the rate is the same for other major suppliers. Japan’s total beef imports have declined this year, reflecting the still relatively weak yen and challenging economic situation.

After a very strong performance in 2024, beef exports to Mexico have trended modestly lower this year. This trend continued in May, as shipments totaled 16,485 mt, down 12% from a year ago, while export value fell 10% to just over $100 million. For January through May, exports to Mexico declined 8% in volume (89,022 mt) and 4% in value ($540.2 million).

Beef exports to Taiwan also trended lower in May, falling 16% from a year ago to 4,934 mt, valued at $55 million (down 13%). For January through May, export value to Taiwan increased slightly to $256.7 million (up 1%) despite a 7% decline in volume (21,638 mt).

Led by growth in the Dominican Republic, Bahamas and Netherlands Antilles, beef export value to the Caribbean climbed 25% from a year ago in May, reaching $28.2 million. This was achieved despite a 4% decline in volume (2,716 mt). Through the first five months of the year, export value to the Caribbean was 13% ahead of last year’s pace at $137.8 million, while volume was down 5% to 14,086 mt. Shipments to the Dominican Republic are on a record pace, averaging more than 1,000 mt over the past four months.

Although beef exports to the Middle East were lower in May, the United Arab Emirates (UAE) emerged as a bright spot. Shipments to the UAE climbed 66% from a year ago to 468 mt, while value increased 47% to $6.2 million. For January through May, shipments to the UAE were still 15% below last year at 2,132 mt, but value jumped 12% to $32.5 million.

Beef exports to Africa – the vast majority of which are variety meat – have trended higher in 2025, driven mainly by growth in Cote D’Ivoire and Morocco. May exports to Africa totaled 1,209 mt, up 7% from a year ago, while value climbed 18% to just over $2 million. May shipments to Cote d’Ivoire (635 mt) were the highest since 2017. Through May, beef exports to Africa increased 14% to 5,974 mt, valued at $9.4 million (up 27%).

May beef export value equated to $406.05 per head of fed slaughter, down just 1% from a year ago. (Exports to China accounted for just $7.40, compared to more than $66 in May 2024). The January-May average was $413.37 per head, up 1%. Exports accounted for 13.4% of total May beef production and 11.3% for muscle cuts, down slightly from the year-ago ratios of 13.8% and 11.4%, respectively. For January through May, exports accounted for 13.6% of total production and 11.4% for muscle cuts, down from 13.9% and 11.6%, respectively, during the same period last year.

May lamb exports largest of 2025

May exports of U.S. lamb muscle cuts reached a 2025 high of 363 mt, essentially doubling (up 99%) from a year ago, while value increased 71% to $1.8 million. The increase was driven mainly by growth in Mexico, where exports were the largest since 2019 at nearly 200 mt. May shipments also rebounded to Canada.

January-May lamb exports were 44% above last year at 1,367 mt, while value climbed 25% to $7.4 million. Exports to Mexico surged more than 80% in both volume (673 mt) and value ($2.34 million), driven by growing demand for alternative cuts such as shoulder and breast meat. Exports to the Caribbean, which remains the leading value destination for U.S. lamb, increased 17% in both volume (533 mt) and value ($4 million) with export growth to the Dominican Republic, Leeward-Windward Islands, Trinidad and Tobago and Turks and Caicos.

Complete January-May export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). But China imposed an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025, and additional retaliatory duties were announced in April 2025. China’s new retaliatory duties were first announced at 34% but were later increased to 84% and further increased to 125%. The additional tariffs pushed China’s effective duty rate on U.S. pork and pork variety meat to 172% and the rate for beef and beef variety meat increased to 147%. These rates were temporarily lowered to 57% for pork and 32% for beef on May 14, 2025, when the U.S. and China agreed to a temporary de-escalation to allow for further negotiations. Product that shipped prior to April 10 was allowed to clear without the additional 125%, provided it arrived by May 13.

Since March 4, 2025, U.S. sausages entering Canada have been subject to a 25% retaliatory duty.