April Beef and Pork Exports Below Year-Ago; Lamb Trends Higher

Due in part to a sharp decline in shipments to China, April exports of U.S. beef and pork trended lower than a year ago, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). China’s retaliatory duties are a major headwind for both U.S. beef and pork, while beef exporters face an additional obstacle. China has failed to renew establishment registrations for U.S. beef plants and cold storage facilities, the majority of which expired in mid-March.

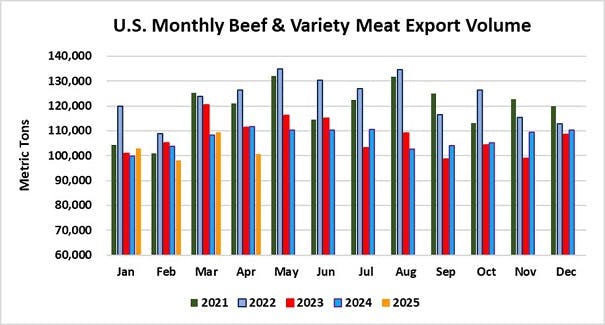

April beef exports totaled 100,659 metric tons (mt), down 10% from a year ago, while value fell 8% to $824.5 million. Exports to China declined nearly 70% and shipments also trended lower to Mexico, Taiwan and the Middle East. These results were partially offset by larger exports to South Korea, Japan and Central and South America.

For January through April, beef exports were 3% below last year’s pace at 411,027 mt. Export value was down just 1% to $3.35 billion.

“We expected beef shipments to China to hit a wall in April, due to the one-two punch of higher tariffs and expired plant registrations,” said USMEF President and CEO Dan Halstrom. “We are hopeful that these issues will be resolved soon and are encouraged by this week’s developments on trade negotiations with China. In the meantime, USMEF remains committed to market diversification and we have accelerated efforts to develop alternative destinations for cuts and variety meat items normally shipped to China.”

China’s total duties on U.S. beef peaked in April at 147%. The rate was lowered to 32% on May 14 when the U.S. and China agreed to a temporary de-escalation to allow for further negotiations. (Product that shipped prior to April 10 was allowed to clear without the additional 125%, provided it arrived by May 13.) President Trump spoke with Chinese President Xi Jinping on June 5 and said further talks will be held soon.

Pork exports totaled 237,250 mt in April, down 15% from a year ago and the lowest in 10 months. Export value fell 13% to $675.3 million. Exports to China, which are mainly pork variety meats, declined 35% from a year ago. Shipments were also lower year-over-year to leading market Mexico and to Japan and Canada. But April was another outstanding month for pork exports to Colombia and Central America, which are both on a record pace.

For January through April, pork exports were 5% below last year’s record pace at 991,738 mt, while value fell 4% to $2.78 billion.

“China has been renewing registrations for U.S. pork establishments, but retaliatory duties remain a significant barrier,” Halstrom said. “Exports to Mexico cooled in April but keep in mind that the year-over-year comparison is with a record performance in April 2024. Year-to-date shipments to Mexico are fairly steady with last year’s record pace and demand elsewhere in Latin America is also very robust.”

China’s total duties on U.S. pork and pork variety meats peaked in April at 172%. The rate was lowered to 57% on May 14. (As with beef, product that shipped prior to April 10 and arrived by May 13 was allowed to clear without the additional 125%.)

Strong April beef demand from Korea, Central and South America

April beef exports to leading value market South Korea totaled 23,460 mt, up 18% from a year ago. Export value was $216.4 million, up 16% and the largest since 2023. These results pushed January-April exports 3% above last year’s pace at 81,638 mt, valued at $784.8 million (up 6%). The June 3 presidential election is expected to restore some level of economic stability in Korea, which has dealt with political turmoil since former president Yoon Suk Yeol was impeached in December.

The trade impasse with China has created some new opportunities for U.S. beef in Korea. For example, greater availability of U.S. short plate opened the door for additional promotions in the retail sector.

Robust demand in Guatemala fueled another excellent month for U.S. beef exports to Central America, which increased 18% from a year ago to 2,113 mt, topping 2,000 for the second consecutive month. This included 1,065 mt for Guatemala, the second largest volume on record. April export value for the region soared 53% to $18.2 million. Through the first four months of 2025, exports to Central America increased 9% to 8,131 mt, while value climbed 30% to $70.7 million. Exports to both Guatemala and Panama are above the record pace established a year ago.

U.S. beef’s presence in Colombia continued to regain momentum in April, with exports climbing 128% from a year ago in volume (447 mt, the highest since February 2024), valued at $4.6 million – up 149% and the highest since September 2023. Exports to Colombia were interrupted last year due to restrictions related to highly pathogenic avian influenza in dairy cows. Full access was restored in September, but the six-month absence from the market was a significant setback. With shipments also increasing to Chile and Peru, April exports to South America increased 41% to 1,864 mt, valued at $15.2 million (up 88%). This included 643 mt of chilled beef to Chile, the highest since 2022. While January-April export volume to South America was down 4% from a year ago at 6,324 mt, value climbed an impressive 29% to $45.8 million.

Other January-April results for U.S. beef exports include:

April beef exports to China totaled 5,326 mt, down 68% from a year ago. Export value fell 69% to $44.4 million. These results pushed January-April exports to China 16% below last year’s pace in volume (50,020 mt) and 15% lower in value ($434.8 million). This downward trend will continue until China restores eligibility for all registered U.S. plants.

Japan maintained its position as the largest volume destination for U.S. beef as April exports increased 6% from a year ago to 22,375 mt, valued at $165.3 million (up 1.5%). For January through April, exports to Japan were 2% below last year’s pace in both volume (82,221 mt) and value ($617 million).

April beef exports to Mexico totaled 17,676 mt, up slightly from March but down 16% from the large year ago volume. Export value was $107.3 million, down slightly from March and 11% lower year-over-year. Mexico’s domestic slaughter increased in the first fourth months of the year, as its exports of feeder cattle to the United States have been interrupted by spread of the New World screwworm. For January through April, beef exports to Mexico were down 6% from a year ago in volume (72,537 mt) and 3% lower in value ($784.8 million).

After a strong performance in March, beef exports to Taiwan took a step back in April at 4,492 mt, down 17% from a year ago, while value fell 8% to $54 million. January-April exports to Taiwan increased 5% in value ($201.7 million) despite a 5% decline in volume (16,704 mt).

Beef exports to the Caribbean have also increased in value in 2025 despite lower volumes. This trend continued in April as exports fell 3% from a year ago to 2,801 mt, but increased 25% in value to $28.6 million. Through April, exports to the region climbed 10% in value to $109.6 million, driven by record-level shipments to the Netherlands Antilles, Leeward-Windward Islands and Turks and Caicos, as well as robust demand in the Bahamas, Jamaica and the Dominican Republic. January-April volume was down 5% at 11,370 mt.

A surge in demand from Cote D’Ivoire and larger shipments to Morocco and Gabon drove April beef exports to Africa 18% above last year at 1,107 mt, valued at $1.6 million (up 17%). Through April, shipments to Africa – which are mostly beef variety meat – increased 16% to 4,765 mt, while value climbed 30% to $7.4 million. January-April shipments were record-large to Morocco (1,429 mt, up 199%), were the highest since 2013 to Cote d’Ivoire (1,716 mt, up 210%), and were the highest since 2020 to Gabon (1,304 mt, up 15%).

Lack of access in Indonesia contributed to the 38% decrease in exports to the ASEAN region in April, totaling 2,404 mt. January-April exports to the region were down 19% in both volume (8,408 mt) and value ($68.6 million).

April beef exports equated to $396.71 per head of fed slaughter, down 5% from a year ago. The January-April per-head average was still up 1% to $415.16. Exports accounted for 13.1% of total April beef production and 11.1% for muscle cuts only, down from 14.1% and 11.7%, respectively, a year ago. The January-April ratios were 13.6% of total production and 11.4% for muscle cuts, down from 13.9% and 11.6%, respectively, a year ago.

April pork exports slow to Mexico and China, trend higher to Colombia, Central America

Pork exports to leading market Mexico totaled 91,441 mt in April, down 15% from the record volume posted a year ago, while value ($197.8 million) was down 18% from the April 2024 record. This broke a remarkable stretch of nine consecutive months in which exports to Mexico topped $200 million in value. For January through April, exports to Mexico were slightly below last year’s record pace at 385,844 mt (down 1%), while value was still 2% higher at $835.6 million. Exports to Mexico averaged 10.7% of U.S. muscle cut production through April, up slightly from the same period last year.

Colombia’s demand for U.S. pork remained red-hot in April, with shipments totaling 12,079 mt – up 58% from a year ago. Export value soared 68% to $34.7 million. Through April, exports to Colombia were 14% above last year’s record pace at 45,343 mt, while value climbed 20% to $130.7 million. While most pork exports to Colombia are muscle cuts, USMEF has heightened promotions of pork variety meat during the trade impasse with China. Variety meat shipments to Colombia more than doubled year-over-year in April, reaching 1,140 mt (up 107%) valued at $3.5 million (up 169%). Frozen pork feet accounted for about one-fifth of this total.

Fueled by larger shipments to Guatemala, Costa Rica, El Salvador, and Panama, April pork exports to Central America totaled 15,644 mt, up 6% from a year ago, valued at $49.4 million (up 12%). Central America also took more pork variety meats in April, with volume (1,246 mt) up 9% from last year’s large total. For January through April, pork and pork variety meat exports to the region were 16% above last year’s record pace at 60,811 mt, with value up 20% to $191.1 million. Growth is broad-based, as exports to Honduras, Guatemala, Costa Rica and Nicaragua were all on a record pace through April.

Other January-April results for U.S. pork exports include:

As noted above, pork exports to China fell sharply in April due to prohibitive retaliatory duties. Exports totaled 26,365 mt, down 35% from a year ago, while value fell 32% to $64.9 million. January-April shipments to China were down 7% in volume (141,584 mt) and 4% lower in value ($342.3 million). While China’s retaliatory duties were lowered on May 14, the total duty rate on U.S. pork cuts and most pork variety meat is still 57%, while most of China’s imports are tariffed at the most-favored-nation rate of 12%.

While below last year’s large total, pork exports to Korea remained relatively strong at 23,954 mt – down 9% from a year ago but up slightly from the strong performance in March. Export value was $79.2 million, down 11% year-over-year but up nearly $2 million from March. Through April, exports to Korea were 14% below last year’s pace at 82,168 mt, valued at $265.8 million (down 15%).

Pork exports to Australia trended higher in April, increasing 4% from a year ago to 8,205 mt, while value climbed 13% to $29.7 million. January-April exports to Australia were fairly steady with last year’s robust pace, down 1% in volume (33,049 mt) but 1% higher in value ($118.7 million).

April pork exports to Japan totaled 30,015 mt, down 13% from a year ago, while value declined 15% to $118.4 million. January-April shipments to Japan were down 14% in volume (105,858 mt) and 15% lower in value ($423.2 million).

Canada’s demand for U.S. pork slowed significantly in April, down 45% from a year ago to 8,282 mt. Export value was $33.9 million, down 41%. These results pushed January-April shipments to Canada 16% below last year’s pace at 58,344 mt, while value fell 14% to $235.1 million. Since March 4, Canada has imposed a 25% retaliatory duty on U.S. sausages. However, the decline has been mostly driven by other product categories as Canada’s imports of U.S. sausages were down only slightly through April. It is also worth noting that Canada’s exports of pork to the U.S. were down 9% in the first four months of the year, but Canada is exporting significantly larger volumes to Japan (up 21%), China (up 9%), Mexico (up 17%), Korea (up 29%) and Taiwan (up 38%).

April pork exports equated to $62.50 per head slaughtered, down 14% from the very high average in April 2024. For January through April, the per-head average was down 2% to $64.98 per head. Exports accounted for 28.1% of total April pork production and 25.2% for muscle cuts only, down significantly from the respective year-ago ratios of 33.3% and 28.8%. For January through April, exports equated to 29.6% of total production and 26% for muscle cuts, down from 30.7% and 26.5%, respectively, a year ago.

Demand from Mexico keeps April lamb exports on upward trend

April exports of U.S. lamb muscle cuts totaled 257 mt, up 49% from a year ago, while value increased 15% to $1.44 million. Growth was driven by a near-doubling of shipments to leading market Mexico, which increased 97% to 118 mt. For the first time since 2014, shipments to Mexico have been above 100 mt for four consecutive months. For January through April, lamb muscle cut exports increased 31% year-over-year to 1,004 mt, while value was up 16% to $5.6 million, with shipments trending higher to Mexico and the Caribbean.

Complete January-April export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). But China imposed an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025, and additional retaliatory duties were announced in April 2025. China’s new retaliatory duties were first announced at 34% but were later increased to 84% and further increased to 125%. The additional tariffs pushed China’s effective duty rate on U.S. pork and pork variety meat to 172% and the rate for beef and beef variety meat increased to 147%. These rates were lowered to 57% for pork and 32% for beef on May 14, 2025, when the U.S. and China agreed to a temporary de-escalation to allow for further negotiations. Product that shipped prior to April 10 was allowed to clear without the additional 125%, provided it arrived by May 13.

Since March 4, 2025, U.S. sausages entering Canada have been subject to a 25% retaliatory duty.