U.S. Pork Exports Rebounded in June; China’s Lockout Weighed on Beef Results

Exports of U.S. pork bounced back in June, finishing the first half of 2025 on a high note, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef export volume was the lowest in five years, due in part to China’s failure to renew registrations for the vast majority of U.S. plants.

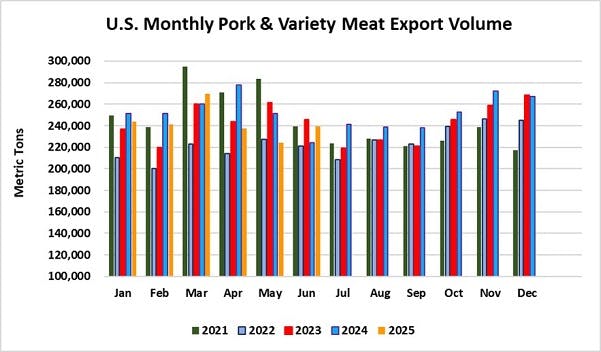

June pork exports totaled 239,304 metric tons (mt), up 7% from a year ago, while value increased 3.5% to $682.6 million. For the first half of the year, exports were down 4% from last year’s record pace at 1.46 million mt. Export value was $4.11 billion, down 3.5% from a year ago but still the third highest first-half total on record.

“We anticipated a June rebound for pork, following the de-escalation of trade tensions with China after the negotiations held in Geneva in May,” said USMEF President and CEO Dan Halstrom. “China still tariffs most U.S. pork items at 57%, but at least the industry can move some pork variety meats at that rate. Elsewhere, June was another terrific month for U.S. pork in Mexico and demand was outstanding in Central America and Colombia. These critical free trade agreement partners continue to shine, as U.S. pork underpins consumption growth across the region.”

Beef exports totaled 93,928 mt in June, down 15% from a year ago and the lowest since June 2020. Export value was $769 million, down 18% and the lowest in 17 months. For January through June, beef exports were 6.5% below last year’s pace at 602,221 mt, while value fell 6% to $4.92 billion.

Lack of access to China not only results directly in lost business and missed opportunities, but the U.S. beef industry is also losing the premiums generated when Chinese buyers compete for cuts that are especially popular throughout Asia, such as short plate, top blade, chuck rolls and short ribs. Without exports to China, USMEF estimates the U.S. beef industry’s lost opportunity at $150 to $165 per head of fed slaughter, or about $4 billion annually.

“The June export results really underscore the urgent need to resolve this impasse with China,” Halstrom said. “China’s tariff rate on U.S. beef is currently 32% – which is too high, but not insurmountable. The problem is, with only a few plants eligible to ship to China, the tariff rate becomes irrelevant. Consistent and transparent plant approvals, without expiration, were among the most important components of the 2020 Phase One Agreement with China, and it’s time for China to return to those commitments.”

While USMEF remains hopeful that access to China will be restored soon, the current situation highlights the importance of diversification and further development of emerging markets such as Central America and Southeast Asia.

June pork highlights include value surge for Mexico, variety meat rebound

Leading market Mexico was the pacesetter for June pork exports at 102,750 mt, up 24% from a year ago. Export value soared 33% to $249.4 million – the second highest on record, trailing only December 2024. This included a 20% increase in muscle cuts to 85,709 mt, accounting for 12% of U.S. pork production for the month. These exports went at higher prices, as value increased by one-third to $221 million. For the first half of 2025, Mexico accounted for nearly 11% of U.S. pork muscle cut production.

June shipments of pork variety meats to Mexico also increased sharply, up 44% to 17,041 mt, with value climbing 36% to $28.6 million. Pork and pork variety meat shipments to Mexico closed the first half at 586,291 mt, 4% above last year’s record pace, while value climbed 8% to $1.3 billion.

While June pork exports to China were modestly lower than a year ago – 33,735 mt, down 2% – volume was sharply higher than in May and well above the total posted in April. Although China’s tariffs were reduced in May from the prohibitive April rates, they remain well above normal levels. This is reflected in lower export prices, as June export value was $72.7 million, down 11% year-over-year. The June results included 23,778 mt of pork variety meat, which was steady with last year, while value was down 8% to $56.6 million. The rebound in China (compared to May) contributed greatly to a strong month for U.S. pork variety meat exports globally, with volume up 10% from a year ago to 49,494 mt, valued at $100.8 million (up 4%). In addition to Mexico, markets posting year-over-year gains for June variety meat exports included Central and South America, South Korea, Vietnam and Trinidad and Tobago.

Led by growth in Honduras, Guatemala, El Salvador, Panama and Costa Rica, June was another outstanding month for pork exports to Central America. Shipments climbed 32% from a year ago to 13,685 mt, while value increased 26% to $43.3 million. First-half pork shipments to the region totaled 89,260 mt, up 20% from last year’s record pace, while value climbed 22% $282.1 million.

Other January-June results for U.S. pork exports include:

With demand climbing in Colombia’s retail and foodservice sectors, pork exports to Colombia have soared in 2025. June exports totaled 8,480 mt, up 11% from a year ago, valued at $31.3 million (up 20%). Through the first half of the year, shipments to Colombia were 17% above last year’s record pace at 66,450 mt, while value climbed 21% to $190.5 million.

Surging demand in Cuba and larger shipments to the Dominican Republic and Trinidad and Tobago pushed June pork exports to the Caribbean to 10,237 mt, up 22% from a year ago, while value increased 21% to $31.3 million. First-half exports to the Caribbean increased 5% from a year ago in value ($192.6 million), despite a slight decline in volume (63,305 mt, down 1%).

Although June pork exports trended lower to the ASEAN region, Vietnam emerged as a bright spot as shipments reached 1,246 mt, up 760% from last year’s minimal volume and the highest since 2020. Export value climbed 340% to $1.7 million. First-half exports to Vietnam were still down 9% year-over-year at 2,866 mt, valued at $4.6 million (down 25%). President Trump recently announced a trade deal with Vietnam, and it is essential that tariff and non-tariff barriers are eliminated in this highly competitive market, where the U.S. is at a disadvantage to most competitors because of various trade agreements. Trade frameworks were also announced with the Philippines and Indonesia, but the details have yet to be finalized. There are also expectations of announcements for Thailand and Malaysia. First-half pork exports to the ASEAN region were just under 33,000 mt, down 17% from a year ago, while value fell 4% to $81.2 million.

The Trump administration also recently reached a trade deal with Japan, where first-half pork exports totaled 162,315 mt, down 11% from a year ago, valued at $646.3 million (down 12%). Japan’s duties have been eliminated on ground seasoned pork, canned hams and sausages. Tariffs are also being phased to zero for all processed products and for muscle cuts entering above the gate price of 524 yen/kg. These access terms were agreed in the U.S.-Japan Trade Agreement under the first Trump administration, which ensured that U.S. pork was on a level playing field with Japan’s other major suppliers. This year Japan is importing more frozen and ground seasoned pork from the U.S., but less chilled pork, as importers continue to seek value options due to the relatively weak yen and lack of disposable income growth.

A trade deal was also recently announced with Korea, where first-half pork exports were down 13% from a year ago to 117,823 mt, valued at $379.2 million (down 17%). U.S. pork enters Korea at zero duty under the Korea-U.S. Free Trade Agreement. Most major pork suppliers also have duty-free access to Korea, although Brazil and Mexico are notable exceptions.

Pork export value equated to $68.49 per head slaughtered in June, up 3% from a year ago, while the January-June average was down 2% to $65.07. Exports accounted for 31.3% of total June pork production and 26.7% for muscle cuts, each up about 1.5 percentage points from a year ago. The January-June ratios were 29.6% of total production and 26.1% for muscle cuts, down from 30.5% and 26.3%, respectively, in the first half of 2024.

June beef exports sharply lower, but bright spots include Korea, Mexico, Central and South America

Beef exports to leading market South Korea totaled 19,310 mt, steady with a year ago, though value fell 5% to $181 million. January-June shipments increased 8% to 126,177 mt, while value climbed 9% to $1.2 billion. While a recently announced trade deal has restored some degree of certainly to U.S.-Korea trade relations, it is still unclear whether progress will be made on Korea’s non-tariff barriers – including its restrictions on certain products from cattle under 30 months of age, a 100-days-on-feed requirement for imported Canadian cattle and a ban on beef from cattle more than 30 months of age.

But U.S. beef remains well-positioned in Korea, with a current tariff rate of just 2.7%, which will fall to zero at the beginning of next year, ahead of the competition. Before the Korea-U.S. Free Trade Agreement, U.S. beef was tariffed at 40%.

Beef exports to Central America are on a record pace in 2025, and June was another robust month. Led by growth in Guatemala and Costa Rica, exports to the region reached 1,479 mt, up 11% from a year ago, while value soared 37% to $14 million. First-half exports to Central America totaled 11,655 mt, up 8% from a year ago, with value climbing 32% to $103.2 million. Exports to Guatemala are on pace to set a record for the ninth consecutive year in 2025, while shipments to Panama are also on a record pace.

June beef exports to Mexico were also steady with last year at 17,066 mt, while value increased 9% to $107.2 million. Shipments to Mexico closed the first half of the year at 106,088 mt, down 7% from a year ago, while value was down 2% to $647.3 million.

Other January-June results for U.S. beef exports include:

Robust growth in Chile, an ongoing rebound in Colombia and the largest volume of the year to Peru fueled strong June beef exports to South America. June shipments totaled 1,818 mt, up 33% from a year ago, while value soared 94% to $14.2 million. While January-June exports to the region were up just 3% in volume (9,588 mt), value climbed an impressive 39%. Growth was primarily led by Chile but demand is recovering in Colombia, where access was restricted for much of 2024 due to avian influenza-related restrictions. Full access to Colombia was restored in late September.

Beef variety meat exports to Egypt had trended lower for the past few months but rebounded in June to 3,522 mt, up 16% from a year ago and the highest since January. Export value climbed 39% to $6.4 million. January-June beef variety meat exports to Egypt were 5% below last year’s pace at 19,129 mt, but value increased 12% to $34.7 million. The U.S. industry also received great news from the Middle East last week when restrictions related to halal certification were lifted in United Arab Emirates (UAE). The UAE is traditionally the region’s largest market for U.S. beef muscle cuts, while most exports to Egypt are livers and other variety meat.

June beef exports to Africa, which are also primarily variety meat, totaled 1,191 mt, up 73% from a year ago, while export value doubled to just under $2 million. Beef variety meat exports were led by growth in Cote D’Ivoire, Morocco and Gabon, January-June shipments to Africa increased 21% from a year ago to 7,165 mt, valued at $11.4 million (up 37%).

As noted above, China is all but closed to U.S. beef, with only a handful of plants eligible to ship. June exports plummeted to just 3,104 mt, down 77% from a year ago, while value fell 80% to $24.1 million. Despite a fairly strong start to the year, January-June exports to China totaled 54,522 mt, down 38% from a year ago, while value fell 40% to $473.4 million.

June beef exports to Japan totaled 19,993 mt, down 10% from a year ago, while value declined 19% to $147.3 million. First-half exports to Japan were down 2% to 124,005 mt, valued at $920.3 million (down 6%). The Trump administration recently announced a trade and investment agreement with Japan, but major changes in beef market access are not anticipated. Japan’s tariff rate on U.S. beef is currently the highest of any major import market at 21.6%, but it phases to 9% by 2033 under the U.S.-Japan Trade Agreement signed in 2020. U.S. beef is on a level playing field with Japan’s other major suppliers, but Australia is also shipping less beef to Japan as demand has suffered from the combination of a weak yen, high import duties, and lack of consumer income growth.

Beef exports equated to $392.72 per head of fed slaughter in June, down 14% from a year ago (again, reflecting the absence of China). The January-June average was $410.00, down 2% from the first half of 2024. Exports accounted for 13.1% of total June beef production and 10.9% for muscle cuts, down from the very high ratios of 15% and 12.8%, respectively, in June 2024. For January through June, exports accounted for 13.5% of total beef production and 11.3% for muscle cuts, each down about one-half percentage point from the first half of last year.

June lamb exports above year-ago, but lowest of 2025

Exports of U.S. lamb muscle cuts totaled 223 mt in June, up 37% from last year’s low volume, and export value was $905,000, up 21% from a year ago. However, both export volume and value were the lowest this year. Led by growth in Mexico, Canada, Trinidad and Tobago, Leeward-Windward Islands and Turks and Caicos, January-June lamb exports increased 43% to 1,590 mt, valued at $8.3 million (up 25%).

Complete January-June export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). But China imposed an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025, and additional retaliatory duties were announced in April 2025. China’s new retaliatory duties were first announced at 34% but were later increased to 84% and further increased to 125%. The additional tariffs pushed China’s effective duty rate on U.S. pork and pork variety meat to 172% and the rate for beef and beef variety meat increased to 147%. These rates were temporarily lowered to 57% for pork and 32% for beef on May 14, 2025, when the U.S. and China agreed to a temporary de-escalation to allow for further negotiations. Product that shipped prior to April 10 was allowed to clear without the additional 125%, provided it arrived by May 13.

Since March 4, 2025, U.S. sausages entering Canada have been subject to a 25% retaliatory duty.