Robust Red Meat Exports in November; Pork Remains on Record Pace

November exports of U.S. red meat posted year-over-year gains across all categories, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). U.S. pork exports remained on a record pace, while beef and lamb shipments also increased substantially from November 2023.

Pork exports totaled 272,141 metric tons (mt) in November, up 5% from a year ago, while export value increased 6% to just under $783 million. These results included an especially strong month for pork muscle cut exports, which increased 6% to 221,652 mt. Muscle cut export value was the third highest on record at $671.4 million.

“Another terrific month for pork demand in Mexico and throughout the Western Hemisphere,” noted USMEF President and CEO Dan Halstrom. “It was also encouraging to see exports trend higher to Japan and sustain strong growth in Oceania and Southeast Asia.”

Through the first 11 months of 2024, pork exports were also up 5% year-over-year in volume (2.76 million mt) and 6% in value ($7.85 billion). When December results are available, exports will exceed 3 million mt for the first time, topping the previous high (2.98 million mt) reached in 2020. Export value will exceed $8.5 billion, easily surpassing the 2023 record of $8.16 billion.

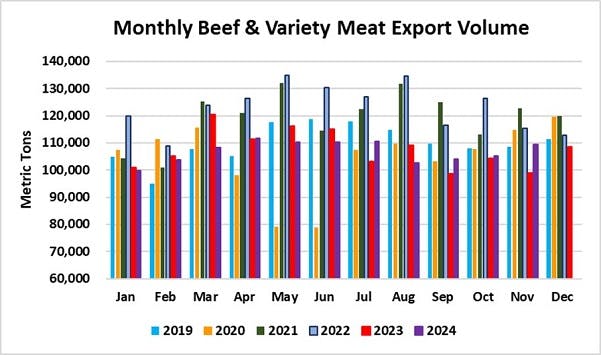

November beef exports increased 10% year-over-year to 109,288 mt, while value climbed 11% to $872.7 million. For January through November, exports increased 5% in value ($9.56 billion) from the same period in 2023, despite a 1% decline in volume (1.18 million mt).

“Despite continued economic headwinds in Asia, demand for U.S. beef strengthened in South Korea, China and Taiwan, and exports were fairly steady to Japan,” Halstrom said. “The strong performance in Mexico and outstanding demand for variety meat in Egypt were also critical for bolstering carcass value.”

Pork exports already top annual records in Colombia, Central America

November pork exports to leading market Mexico totaled 99,849 mt, the fourth highest this year and nearly matching the very strong volume from a year ago, while export value increased 2% to $225.7 million. The USDA Food Safety and Inspection Service transitioned to electronic export certificates for Mexico on Nov. 4, leading to delays for some shipments, but November volumes confirm these obstacles were temporary.

January-November exports to Mexico were 5% above the record pace of 2023 (when exports increased by 14% over 2022) at 1.05 million mt. Export value climbed 10% to $2.33 billion – only slightly below the full-year value record ($2.35 billion) posted in 2023.

Pork exports to Colombia were record-large in November, climbing 19% from a year ago in volume (14,471 mt) and 23% in value ($42.1 million). With one month to spare, exports to Colombia already set annual records, soaring 29% to 114,619 mt and exceeding the previous full-year high of 106,456 mt reached in 2021. Export value jumped 36% to $329.4 million, topping the previous full-year record ($272 million) from 2023.

Despite modestly lower shipments to leading markets Honduras and Guatemala, November pork exports to Central America still increased 14% from a year ago to 18,896 mt and climbed 15% in value to $59 million. Shipments were record-high to Nicaragua, El Salvador and Belize and were the second largest on record to Costa Rica. Through November, exports to the region already exceeded previous full-year highs for volume and value, both of which were reached in 2023. January-November shipments increased 20% to 143,131 mt, valued at just under $450 million (up 28%).

Other January-November results for U.S. pork exports include:

November was another outstanding month for pork exports to Oceania, with shipments increasing 28% from a year ago to 8,221 mt, while value climbed 29% to $30.1 million. Fueled by strong demand in both Australia and New Zealand, January-November exports soared 33% to 92,902 mt, which is already the second largest (behind 2109) year on record for the region. Export value increased 36% to $337.7 million, just short of the previous full-year high reached in 2019. Exports to New Zealand are on a record pace, while exports to Australia will be the second largest on record, trailing only 2019.

Another strong performance in the Dominican Republic and robust growth in Cuba pushed November pork exports to the Caribbean to 12,947 mt, up 2% from a year ago, valued at $39.3 million (up 1%). Through November, exports to the region increased 5% to 116,849 mt, while value climbed 8% to $347.1 million. December exports will likely push 2024 exports past the annual records (121,652 mt valued at $354.8 million) set in 2023. This will be achieved despite heightened competition in the DR from Brazilian pork.

November pork exports to Japan increased 3% year-over-year to 27,699 mt, while value was 4% higher at $116.1 million. January-November exports to Japan were still down 1% from a year ago at 313,033 mt, but value edged slightly higher to $1.29 billion.

Shipments increased year-over-year to the Philippines, Malaysia and Vietnam, fueling a 65% increase in November pork exports to the ASEAN region in both volume (5,517 mt) and value $11.6 million. January-November exports to the ASEAN increased 21% from a year ago to 72,678 mt, while value was 13% higher at $160 million. Exports to Malaysia already set annual records at 7,770 mt (up 71%) valued at $24.3 million (up 70%).

Although pork exports to China/Hong Kong remain well below the large volumes seen earlier this decade, the market has recently regained significant momentum. November exports totaled 44,973 mt, up 23% from a year ago, while value increased 22% to $110.2 million. January-November shipments to China/Hong Kong were still down 7% in volume (434,583 mt) and 11% in value ($1.04 billion). China/Hong Kong is the largest destination for U.S. pork variety meat, which accounts for more than two-thirds of total export volume to China.

Pork export value climbed to $72.20 per head slaughtered in November, up 9% year-over-year and the highest since April. The January-November average was $66.05 per head, up 5%. Exports accounted for 32.4% of total November pork production and 28.4% of muscle cuts, each up more than two full percentage points from a year ago. January-November exports accounted for 30.1% of total production and 26% of muscle cuts, up from 29.4% and 25.2%, respectively, during the same period in 2023.

Key Asian markets, Mexico, Egypt push November beef exports higher

Beef exports to leading value market South Korea reached 21,499 mt in November, up 20% year-over-year and the largest since March. Export value increased 29% to $207.7 million, also the highest since March. For January through November, exports to Korea achieved a 5% increase in value ($2.01 billion) despite a 7% decline in volume (210,282 mt).

While this was the third consecutive month of renewed momentum for U.S. beef in the Korean market, the outlook for December is cloudy as Korea has been mired in political turmoil and the won recently weakened to its lowest level in 15 years versus the U.S. dollar.

Following a September-October slowdown, beef exports to Taiwan rebounded in November to 5,089 mt, up 40% from a year ago, while export value climbed 43% to $58.6 million. Through the first 11 months of 2024, shipments to Taiwan were steady with the previous year’s pace at 56,352 mt, while value climbed 9% to $632.4 million.

Mexico’s demand for U.S. beef remained robust in November, with exports increasing 6% from a year ago to 18,914 mt, while value was up 4% to $107.4 million. January-November exports to Mexico reached 211,920 mt, up 12% year-over-year, while value jumped 14% to $1.23 billion. Both already exceed the full-year totals from 2023 and export value is the highest since 2009.

Other January-November results for U.S. beef exports include:

Beef exports to China/Hong Kong trended lower in 2024 but showed renewed momentum for the second consecutive month. November shipments increased 8% from a year ago to 18,895 mt, while value climbed 5% to $165.8 million. January-November shipments to the region were still down 7% year-over-year in volume (196,437 mt) and 3% in value ($1.81 billion). China’s Ministry of Commerce recently opened a safeguard investigation on the impact of rising beef imports on domestic producers, with an investigation period of 2019 through June 2024. China’s overall beef imports set another record in 2024, mainly due to growth from South America.

November beef exports to Egypt, a critical destination for U.S. livers and other variety meat, increased 70% from a year ago to 3,955 mt, the highest since 2022. Export value climbed 81% to $6.6 million. This pushed November shipments to the Middle East 40% above a year ago, despite a severe decline to the United Arab Emirates (UAE) due to an impasse over halal certification. This obstacle has been temporarily resolved but regaining full access to the UAE remains a top priority for the U.S. industry. November shipments to Qatar were the highest since 2011 at 362 mt, up 59% from a year ago, while value was record-high at $4.3 million. Through November, beef shipments to the Middle East region increased 25% in volume (49,901 mt) and 17% in value (215.8 million). This included a 24% increase to Egypt, where exports reached 36,233 mt, while value was up 7% to $58.3 million.

Strong growth in the Dominican Republic, Cuba and the Netherlands Antilles pushed beef exports to the Caribbean up 21% from a year ago to 2,702 mt, while value climbed 28% to just under $27 million. November exports to the DR topped 1,000 mt for the fifth time and shipments to the Netherlands Antilles (346 mt, up 21%) were the second highest on record. January-November exports to the Caribbean region totaled 29,655 mt, up 21%, while value increased 12% to $255.7 million.

Larger shipments to the Philippines and Indonesia and the highest volume to Vietnam since 2022 drove November exports to the ASEAN region to 3,841 mt, up 67% from a year ago, while value soared 62% to $26.5 million. Despite market access obstacles in Indonesia and tariff disadvantages in Vietnam, January-November exports to the region increased 6% from a year ago to 39,802 mt, while value climbed an impressive 39% to $322.1 million.

Led by growth in Guatemala, Panama, Honduras and El Salvador, beef exports to Central America increased 12% from a year ago to 2,171 mt, while value edged slightly higher to $15.3 million. January-November shipments to the region increased 5% to 20,072 mt, valued at $147.1 million (up 9%). Exports have set an annual record in Guatemala each year since 2014, and shipments will be record-large again in 2024. January-November totals for Honduras and Panama have already surpassed previous full-year records.

Beef export value equated to $428.70 per head of fed slaughter in November, up 13% from a year ago and the highest since June. This pushed the January-November average to $412.58, up 5%. Exports accounted for 14.4% of total November beef production and 11.8% of muscle cuts, up substantially from the year-ago ratios of 12.7% and 10.4%, respectively. January-November exports accounted for 13.8% of total production and 11.5% of muscle cuts, down slightly from 13.9% and 11.7%, respectively, during the same period in 2023.

Mexico fuels growth in November lamb exports

November exports of U.S. lamb totaled 130 mt, up 13% from the low volume posted a year ago, while value increased 8% to $881,000. Growth was led by larger shipments to Mexico, while exports also edged higher to the Bahamas and Netherlands Antilles. Lamb muscle cut exports to Mexico totaled 69 mt, up 35% from a year ago and the highest in five months.

Through November, lamb exports increased 12% year-over-year to 2,428 mt, valued at just over $13 million (up 13%), led by growth in the Caribbean (mainly the Bahamas and Leeward-Windward Islands), Mexico, the Philippines and Guatemala. Lamb muscle cut exports to Mexico totaled 695 mt, up 18% and the highest since 2017, as a wider range of cuts – including loin, shoulder and flap meat – gained traction with importers.

Complete January-November export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).