October Pork Exports Largest Since March; Encouraging Rebound for Beef

U.S. pork exports continued to build momentum in October, led by a record performance in leading market Mexico, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). While beef exports remained lower year-over-year, shipments rebounded to some degree in October, posting the largest totals since June.

Pork exports totaled 264,657 metric tons (mt) in October, up 5% from a year ago, valued at $762.1 million (up 7%). Both volume and value were the largest since March, led by substantial growth in Mexico and year-over-year increases to Central America, Canada, Japan, South Korea and the Philippines.

January-October pork exports reached 2.43 million mt, just 2% below the record pace of 2024. Export value was also down 2% to $6.93 billion. The year-over-year difference is mostly due to a 20% decline in exports to China (which are mainly variety meats), where U.S. pork is subject to burdensome retaliatory duties.

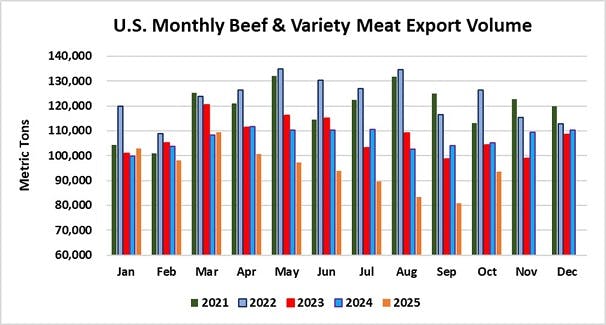

Beef exports totaled 93,448 mt in October, down 11% year-over-year but the largest since June and 16% above the low volume posted in September. Export value was also the highest since June at $759.5 million, down 12% from a year ago but 15% above September. October beef exports increased year-over-year to Japan, Taiwan, Canada, the ASEAN region and the Dominican Republic, while also jumping sharply to Colombia. But these gains were more than offset by lack of access to China, which has reduced exports to minimal volumes for the past several months. For markets other than China, October beef exports were up 5% year-over-year in volume and up 7% in value.

January-October beef exports totaled 949,471 mt, down 11% from the 2024 pace, while value was down 10% to $7.79 billion. When excluding China from these results, exports were down 3% in volume and just 1% in value compared to the first 10 months of 2024.

“The latest export data confirm what I consistently hear from customers across the world and from our international staff – that global demand for U.S. red meat remains robust, despite tight supplies and formidable market access barriers,” said USMEF President and CEO Dan Halstrom. “Obviously, regaining access for U.S. beef in China is our most urgent priority, as industry losses from this lockout are enormous. But we are also hopeful that ongoing trade negotiations will remove barriers in other destinations where consumers have a growing appetite for high-quality red meat.”

Record-large shipments to Mexico fuel strong October pork exports

October pork exports to Mexico totaled 123,058 mt, up 25% from a year ago and topping the previous record (April 2024) by 14%. Export value reached $289 million, up 33% year-over-year and exceeding the previous high (September 2025) by 11%. Through the first 10 months of 2025, shipments to Mexico were 7% above the previous year’s record pace at 1.01 million mt, while value climbed 11% to $2.33 billion.

With two months still to be reported, exports to Mexico already topped 1 million mt for the third consecutive year and $2 billion for the fourth straight year. But the U.S. industry faces a potential headwind in the year ahead, with Mexico opening an antidumping and anti-subsidy investigation on imports of U.S. hams and pork shoulders. USMEF is currently assisting exporters in responding to Mexico’s requests for information related to the investigation, as well as working closely with U.S. trade officials.

Led by gains in Honduras, Guatemala and Costa Rica, October pork exports to Central America climbed 19% year-over-year in volume (17,340 mt) and 26% in value ($59 million). Exports to both Honduras (6,085 mt, up 21%) and Guatemala (4,102 mt, up 35%) reached monthly records, while shipments to Costa Rica (2,358 mt, up 44%) were the second highest on record. January-October shipments to the region were 20% above the previous year’s record pace at 149,111 mt, and 23% higher in value at $481 million. With the exception of Belize, every country in Central America is among the top 15 global destinations for U.S. pork.

After slowing in the first half of 2025, pork exports to South Korea posted year-over-year gains for the fourth consecutive month in October, reaching 12,563 mt (up 12%), valued at $41.3 million (up 8%). January-October exports to Korea were down 6% from a year ago at 171,045 mt, while value ($553.1 million) fell 11% from the record pace of 2024.

Other January-October results for U.S. pork exports include:

October was an encouraging month for pork exports to Canada, which increased 6% from a year ago to 17,778 mt, while value climbed 14% to $72 million. Full market access was restored Sept. 1, when Canada lifted a 25% tariff on U.S. sausages that had taken effect in early March. For January through October, pork exports to Canada were down 14% from a year ago in volume (148,790 mt) and 11% lower in value ($617.3 million).

Pork exports to Japan totaled 27,000 mt in October, up 5% from a year ago and the largest since May, while value was steady at $108 million. Through October, exports to Japan were 8% below the previous year’s pace in volume (262,083 mt) and 11% lower in value ($1.05 billion). Japan’s temporary suspension of pork imports from Spain (due to recent African swine fever cases) could enhance export opportunities in coming months.

Led by year-over-year growth in the Philippines, October pork exports to the ASEAN region increased 34% to 7,841 mt, while export value increased 30% to $18.5 million. Through the first 10 months of 2025, shipments to the region increased 2% in value ($150.7 million) despite falling 4% in volume (64,250 mt). The Philippines, Malaysia and Indonesia have also temporarily suspended pork imports from Spain.

October pork exports to the Caribbean were modestly lower at 12,285 mt (down 6% year-over-year), but still achieved a 5% increase in value ($41.2 million). Led by growth in Cuba and the Bahamas and a fairly steady performance in the Dominican Republic, January-October shipments to the region increased 1% to 104,742 mt, while value climbed 6% to $325.2 million.

Retaliatory duties weighed on U.S. pork exports throughout 2025. China’s total tariff on U.S. pork and most variety meat was 57% for much of last year (and prohibitively high at 172% in April-May), before being reduced to 47% in early November. Consumption has also weakened in China, while domestic production is record-large. For January through October, U.S. exports to China – the majority of which are pork variety meat – totaled 314,955 mt, down 20% from the same period in 2024 (when the total tariff rate was 37%), while value also declined 20% to $721.8 million.

October pork export value equated to $64.44 per head slaughtered, up 8% from a year ago. The January-October average was $65.09 per head, down less than 1% from the same period in 2024. Exports accounted for 28.8% of total October pork production and 25.6% for muscle cuts, up from 27.6% and 23.8%, respectively, in October 2024. The January-October ratios were 29.6% of total production (down slightly year-over-year) and 25.9% for muscle cuts (up slightly).

Bright spots for October beef exports include Japan, Taiwan, Caribbean, Colombia

With a strong October performance, Japan maintained its position as the leading volume destination for U.S. beef exports. October exports to Japan totaled 19,734 mt, up 17% from a year ago, while value increased 16% to $149.8 million. It was an especially robust month for beef variety meat shipments to Japan (mainly tongues and skirts), which topped $50 million in value for the first time since July 2022. For January through October, beef and beef variety meat exports to Japan were down 2% year-over-year to 201,221 mt, while value fell 6% to $1.49 billion.

South Korea is the leading value destination for U.S. beef, but exports took a step back in October as shipments fell 15% year-over-year to 16,690 mt, valued at $153 million (down 20%). Through the first 10 months of 2025, beef exports to Korea remained 3% higher in both volume (194,407 mt) and value ($1.85 billion) compared to the same period in 2024.

Although beef exports slowed to Taiwan in 2025, October brought a welcome rebound. October shipments to Taiwan totaled 5,475 mt, the largest since June and the second highest monthly total for the year. October shipments were up 41% from the low volume posted in October 2024, while value was up 16% to $56.2 million.

Other January-October results for U.S. beef exports include:

While October beef exports to Central America were lower than a year ago at 1,873 mt (down 15%), export value still increased 26% to $21.5 million. In fact, with two months remaining, beef export value to Central America already surpassed the full-year record set in 2024. January-October exports to the region were valued at $172.1 million, up 30% from the previous year’s pace, while volume was steady at 17,875 mt. Exports to Guatemala, the largest market in the region, are on pace to set an annual record for the 11th consecutive year in 2025.

Led by growth in the Dominican Republic, beef exports to the Caribbean reached 2,592 mt in October, up 5% from a year ago. Export value surged 22% to $27.5 million, the highest since May. January-October shipments to the region increased 13% in value ($258.7 million) despite a 4% decline in volume (25,743 mt). Exports to the Cayman Islands will be record-large in 2025, while exports to the Bahamas should be the highest since 2011.

October beef exports to South America were steady with the previous year at 1,527 mt, but value soared 80% to $17.5 million. Growth was driven by Colombia, where shipments climbed 141% in volume (594 mt) and nearly quadrupled in value ($8.2 million) compared to the low totals of October 2024. At that time, Colombia had just lifted avian influenza-related restrictions on U.S. beef, which were in place for about six months. For January through October, beef exports to South America increased 3% to 15,810 mt, while value climbed 38% to $121.9 million. In addition to the rebound in Colombia, exports were also substantially higher to Chile.

Beef exports to Canada reached 9,392 mt in October, up 23% from a year ago and the largest since July 2024. Export value climbed 37% to $83.3 million, the highest since June. January-October shipments to Canada were 3% below the previous year’s pace in volume (81,250 mt) and 2% lower in value ($743.1 million).

With the market effectively closed to U.S. beef, October exports to China were minimal at 584 mt, down 97% from a year ago. Export value was just $3.3 million, down 98%. These results drove the January-October totals 61% below the 2024 pace at 57,634 mt, while value fell 63% to $490 million.

October beef export value equated to $364.78 per head of fed slaughter, down 4% from a year ago. The January-October average was $390.28 per head, down 5% from the same period in 2024. Exports accounted for 11.7% of total October beef production and 9.1% for muscle cuts, down from 12.5% and 10.3%, respectively, in October 2024. The January-October ratios were 12.8% of total production and 10.5% for muscle cuts, each down one full percentage point from a year ago.

October lamb exports trend lower

Exports of U.S. lamb muscle cuts totaled 161 mt in October, down 12% year-over-year, while value fell 6% to $971,000. October shipments declined to the Caribbean but increased to Mexico and Central America. January-October exports were still up 40% year-over-year in volume (2,340 mt) and 27% higher in value ($12.65 million), led by growth in Mexico, Canada, the Bahamas, Trinidad and Tobago, Costa Rica and Panama.

Complete January-October export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). But China imposed an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025, and additional retaliatory duties were announced in April 2025. China’s new retaliatory duties were first announced at 34% but were later increased to 84% and further increased to 125%. The additional tariffs pushed China’s effective duty rate on U.S. pork and pork variety meat to 172% and the rate for beef and beef variety meat increased to 147%. These rates were temporarily lowered to 57% for pork and 32% for beef on May 14, 2025, when the U.S. and China agreed to a temporary de-escalation to allow for further negotiations. The rates were further lowered to 47% for pork and 22% for beef on Nov. 10, 2025.

Beginning March 4, 2025, U.S. sausages entering Canada were subject to a 25% retaliatory duty. This duty was removed effective Sept. 1, 2025.