March Pork Exports Largest in Nearly Two Years; Beef Exports Show Signs of Rebound

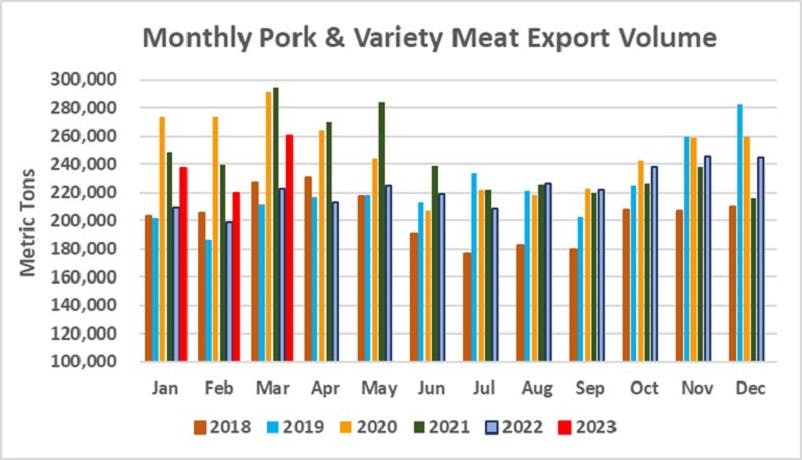

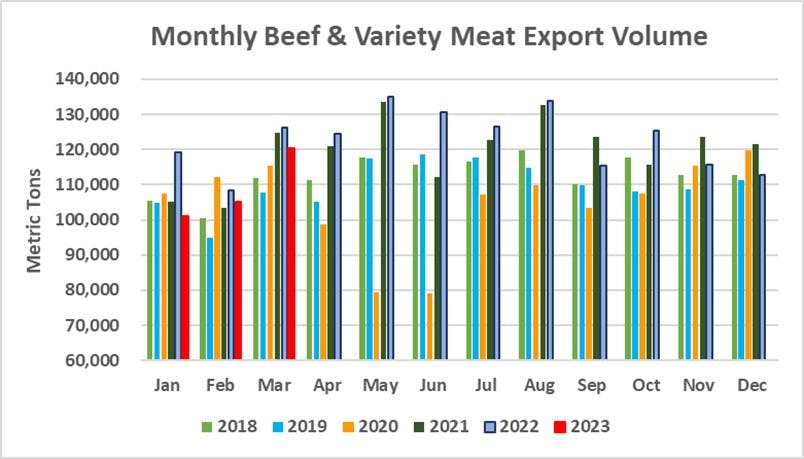

March exports of U.S. pork were the largest since May 2021, according to data released by USDA and compiled by USMEF. While below last year’s high volume, March beef exports were the largest since October.

March pork exports totaled 260,195 metric tons (mt), up 17% year-over-year and the ninth largest volume on record. Export value was also ninth largest at $724 million, up 18% from a year ago. These results capped a strong first quarter for U.S. pork as exports reached 716,691 mt, up 14% from a year ago, valued at $1.96 billion (up 15%).

“It’s great to see U.S. pork exports continue to expand in many of our Western Hemisphere markets, but there is also notable momentum in the Asia Pacific,” said USMEF President and CEO Dan Halstrom. “With consumer activity in the region rebounding toward pre-COVID levels and U.S. pork very competitively priced compared to European product, 2023 holds excellent potential for broad-based growth.”

Beef exports totaled 120,495 mt in March, down 5% from a year ago. Export value fell 17% to $892.6 million, but both volume and value were the highest in five months. Through the first quarter, beef exports were down 8% year-over-year to 326,494 mt, valued at $2.35 billion (down 22%).

“U.S. beef exports faced considerable headwinds late last year and at the beginning of 2023, but the March results show some encouraging trends,” Halstrom said. “Most Asian markets showed renewed momentum in March, while exports continued to trend higher to Mexico, the Caribbean and South Africa.”

Mexico is the pacesetter, but pork exports strengthen in several regions

March was another terrific month for pork exports to Mexico, which remain well above last year’s record pace. March exports totaled 95,030 mt, up 15% from a year ago and the second largest on record (behind January 2023), while value climbed 31% to $195.7 million. First quarter shipments to Mexico were up 11% to 270,056 mt, while value soared 34% to $541.7 million. Brazilian pork gained access to Mexico late last year, and small volumes have arrived in the market. Brazil reported shipments to Mexico of 27 mt in February and 189 mt in March.

March pork exports to the Dominican Republic totaled 13,181 mt, up 87% from a year ago and shattering the previous record (10,681 mt) set in February. Export value to the DR also reached a record $33.6 million, up 88%. With a rapid rebound in tourism, strong retail demand, a significant tariff advantage over other major suppliers and domestic production still limited due to African swine fever (ASF), first quarter exports to the DR climbed 72% from last year’s record pace to 32,047 mt, while export value was up 87% to $85.1 million. Exports also trended higher to the Bahamas, Leeward-Windward Islands, Netherlands Antilles and Cayman Islands and rebounded to Trinidad and Tobago, pushing first quarter shipments to the Caribbean up 63% to 36,598 mt, valued at $101.5 million (up 72%).

With reduced import tariffs and domestic production still struggling to recover from ASF, demand for U.S. pork is strengthening in the Philippines. March exports were the largest since August at 5,077 mt, up 65% from a year ago, valued at $9.6 million (up 42%). First quarter exports to the Philippines totaled 11,769 mt, up 49%, while export value climbed 43% to $28.9 million. For the ASEAN region, first quarter exports increased 49% in volume (13,960 mt) and 40% in value ($35.2 million). Exports to Malaysia are on a record pace at 556 mt, up from just 73 mt a year ago, including record-large shipments of 467 mt in March as Malaysian production is also impacted by ASF and high input costs.

Other first quarter highlights for U.S. pork exports include:

March pork exports to South Korea increased 26% from a year ago to 19,054 mt, with value up 14% to $58.6 million. This pushed the first quarter volume 3% above last year’s pace at 45,059 mt, though value was still down 7% to $143.4 million.

After trending lower in recent years, pork exports to Australia – a key market for boneless hams and loins for further processing – have started to rebound in 2023. First quarter exports climbed 26% from a year ago in both volume (10,106 mt) and value ($36 million).

Pork exports to Japan also edged higher in March, increasing 4% to 33,297 mt, though value was slightly lower at $133.1 million. For the first quarter, exports to Japan trailed last year’s pace by 1% in volume (90,329 mt) and 8% in value ($362.8 million).

Exports to China/Hong Kong continue to trend well above year-ago levels, with first quarter shipments up 29% to 134,881, while export value increased 26% to $352.2 million, mainly driven by the strong growth in variety meats.

Demand for U.S. pork is also rebounding in Taiwan, where first quarter shipments nearly tripled the low volume posted a year ago, climbing 191% to 1,492 mt. Export value soared 275% to $5.5 million.

While China/Hong Kong (see above) remains the top destination for U.S. pork variety meat, first quarter exports also increased significantly to Mexico, the Philippines, Colombia, the Dominican Republic, Honduras and Vietnam. First quarter shipments totaled 147,338 mt, up 37% from a year ago, while value increased 23% to $345.6 million.

March pork export value equated to $63.15 per head slaughtered, up 15% from a year ago, while the first quarter average increased 11% to $60.29. March exports accounted for 29.1% of total pork production and 25% for muscle cuts only. The first quarter ratios were 28.2% and 24.1%, respectively, up from 25.4% and 22.6% in the first quarter of 2022.

Beef exports improving after slow start to the year

Mexico continued to be a bright spot for U.S. beef exports in March, with shipments up 17% from a year ago to 17,454 mt, valued at $97.3 million (up 26%). This pushed first quarter exports to 50,509 mt, up 16% from a year ago, while value increased 17% to $283.6 million. One factor bolstering Mexico’s beef demand in 2023 is the strength of the peso, which has given Mexican customers greater purchasing power compared to buyers in several other key markets. Mexico is the largest volume destination for U.S. beef variety meat, with first quarter exports increasing 13% from a year ago to 25,533 mt, valued at $72.6 million (up 20%). Top variety meat export items to Mexico include livers, tripe, lips, hearts and tongues. First quarter shipments of beef lips were the highest since 2017 at 7,202 mt, up 38% from a year ago, valued at $16.6 million (up 35%).

Although March beef shipments to South Korea were down slightly from a year ago, export volume was the largest in 10 months at 25,605 mt. Export value was down significantly from the enormous total posted in March 2022, but was still the highest since August at $200.5 million. For the first quarter, exports to Korea trailed last year’s record pace by 15% in volume (63,883 mt) and 36% in value ($505.3 million).

March beef exports to China/Hong Kong were also below last year but were the largest since October at 21,211 mt. March export value was $188.5 million, down 9% from a year ago but also the highest since October. First quarter exports to China/Hong Kong were down 11% from a year ago to 55,122 mt, while value fell 18% to $477.2 million.

Other first quarter results for U.S. beef exports include:

Japan is this year’s leading volume market for U.S. beef exports at 69,280 mt, down 4% from a year ago, while first quarter value fell 20% to $473.9 million. Prospects brightened for U.S. beef demand at the end of April, when Japan lifted all COVID-related restrictions for arriving travelers. This is expected to provide a significant boost for Japan’s tourism and hospitality sectors, which have been slow to recover from the pandemic.

Led by impressive growth in the Dominican Republic, Jamaica, the Bahamas, Netherlands Antilles, Trinidad and Tobago, Bermuda and Barbados, first quarter beef exports to the Caribbean climbed 21% from a year ago to 7,638 mt, valued at $67.1 million (up 18%). March shipments to the Dominican Republic were record-large at 1,056 mt, up 9% year-over-year, valued at $11.8 million (up 14%).

The Philippines continues to be a growth market for U.S. beef, with March exports climbing 24% from a year ago to 1,492 mt, valued at $9.3 million (up 3%). First quarter exports increased 15% to 3,782 mt, though value fell 12% to $22.4 million.

Demand for U.S. beef increased dramatically in South Africa, where first quarter exports nearly tripled from a year ago to 5,825 mt – up 184%. All but 33 mt were beef variety meat as shipments of beef livers and kidneys have rebounded following challenges in 2022. Export value to South Africa was up 206% to $6.3 million. With first quarter shipments of beef variety meats also increasing to Cote D’Ivoire, total beef exports to Africa were up 84% from a year ago to 6,816 mt, valued at $7.9 million (up 77%).

Beef variety meat demand also fueled first quarter growth in Peru, where variety meat exports quadrupled from a year ago to 1,024 mt, with value climbing 91% to $1.9 million. March shipments totaled 637 mt, up significantly from the previous year’s muted volumes and the highest since September. Beef muscle cut exports to Peru also trended higher, increasing 49% in volume (488 mt) and 30% in value ($5.5 million).

March beef export value equated to $397.22 per head of fed slaughter, down 16% from a year ago, while the first quarter average was down 21% to $373.42. Exports accounted for 14.6% of total March beef production and 12.3% for muscle cuts only, each down about one-half percentage point from a year ago. The first quarter ratios were 14% and 11.8%, down from 14.7% and 12.5%, respectively, a year ago.

March lamb export volume lower, but value increases

March exports of U.S. lamb muscle cuts totaled 218 mt, down 5% from a year ago, but export value still climbed 11% higher to $1.4 million. First quarter exports increased 35% to 664 mt, valued at $3.7 million (up 23%).

First quarter lamb exports to Mexico were the largest since 2017, while exports also increased to the Netherlands Antilles, the Bahamas, Guatemala and Taiwan.

Complete first quarter export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).