As China Obstacles Persist, Promotions Move More U.S. Beef Short Plate in Korea

International demand is critical for U.S. beef short plate, about 95% of which is exported. Major destinations include Japan, China, South Korea and Taiwan, where short plate is typically sliced thin, marinated and served in hot pot and Korean barbecue-style meals.

U.S. short plate commands a significant premium in these key Asian markets compared to being utilized domestically. But short plate is just one of the U.S. beef cuts entangled in the current trade impasse with China. When China imposed its countermeasures in response to U.S. “reciprocal” tariffs announced in early April, the total tariff rate on U.S. beef soared as high as 147%. While the two sides agreed to a de-escalation in May that temporarily lowered China’s tariff rate on U.S. beef to 32%, this is still far higher than the 12% rate imposed on most suppliers. Australian beef, which is the U.S. industry’s primary competitor in China, currently enters the market at zero duty.

Beyond this tariff disadvantage, U.S. beef faces an additional obstacle: China’s General Administration of Customs has failed to renew registrations for U.S. beef plants and cold storage facilities, a large number of which expired in mid-March when the U.S.-China Phase One Economic and Trade Agreement reached its five-year anniversary. As a result, the majority of U.S. beef production is currently ineligible for China, making it imperative that the U.S. industry find alternative buyers for product originally destined for China.

“In Korea, the price of U.S. short plate fell 20% in the middle of April and further declines were expected,” said Junil Park, U.S. Meat Export Federation (USMEF) director in Korea. “To help support pricing for U.S. short plate, we implemented a unique promotional campaign with one of Korea’s major hypermart retailers.”

While the popularity of U.S. short plate is well-established in Korea’s restaurant sector, Park explains that USMEF is also working to promote short plate as an everyday meal option that consumers can prepare at home.

“Korean demand is strong for U.S. short plate in foodservice and in recent years, USMEF has worked with importers to utilize short plate in home-meal replacement products and meal kits. We also believe that short plate has demand potential with retail consumers as a versatile option for meals prepared at home. This promotion helped demonstrate that potential for retailers,” says Park.

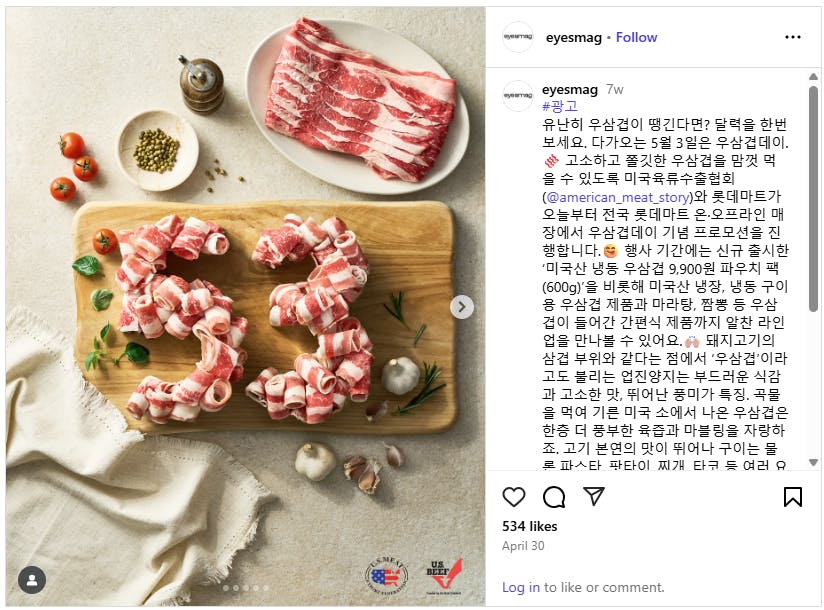

In May, USMEF launched a seven-week promotion at 105 outlets of hypermart retailer Lotte Mart. Under a “day marketing” strategy in which a specific product is promoted annually on that same day, USMEF designated May 3 as “Short Plate Day,” supporting the promotion through a digital marketing campaign. The campaign then shifted toward positioning short plate with consumers as an ideal “everyday” meal option.

Lotte Mart provided additional points of sale in its stores and featured U.S. short plate in its weekly printed leaflets. USMEF support included a digital marketing campaign utilizing paid placement, influencers and USMEF’s social media channels. Funding support for the Lotte Mart promotion was provided by the Beef Checkoff Program.

With Lotte Mart’s sales of U.S. short plate increasing an average of 75%, the promotion captured the attention of other Korean retail chains. Major retailers now running similar promotions include E-Mart Traders, E-Mart and GS Super.

The latest export data, as released by USDA and compiled by USMEF, underscore the urgent need for restoration of market access in China. April beef exports to China plunged by nearly 70% compared to a year ago, reaching just 5,326 metric tons (mt).

“We expected beef shipments to China to hit a wall in April, due to the one-two punch of higher tariffs and expired plant registrations,” said USMEF President and CEO Dan Halstrom. “We are hopeful that these issues will be resolved soon and are encouraged by the recent resumption of trade negotiations with China. In the meantime, USMEF remains committed to market diversification and to developing alternative destinations for beef cuts normally shipped to China.”

Despite the heightened uncertainty surrounding tariffs and other trade barriers, global demand for U.S. beef has held up well in 2025. For January through April, U.S. beef and beef variety meat exports were 3% below last year’s pace at 411,027 mt. Export value was down just 1% to $3.35 billion.