Pork Exports Robust in January; Slow Start for Beef Exports

Slides of January 2023 export highlights

U.S. pork exports, which posted a strong finish in 2022, maintained momentum in January, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). U.S. beef exports were record-breaking in 2022 but slowed late in the year. This trend continued in January, as shipments were well below the large totals from a year ago.

January pork exports totaled 236,767 metric tons (mt), up 13% year-over-year, while export value climbed 16% to $643.4 million. Exports to Mexico, which finished 2022 on a remarkable run on the way to an annual record, set another volume record in January. Exports also trended significantly higher year-over-year to China/Hong Kong, Japan, Canada, the Dominican Republic, Colombia, Honduras and the ASEAN region.

“While Mexico is certainly the pacesetter for U.S. pork exports, it’s encouraging to see such broad-based growth,” said USMEF President and CEO Dan Halstrom. “Market diversification is always a point of emphasis for the U.S. industry, and it’s more important than ever to find new opportunities for U.S. pork in both established and emerging markets.”

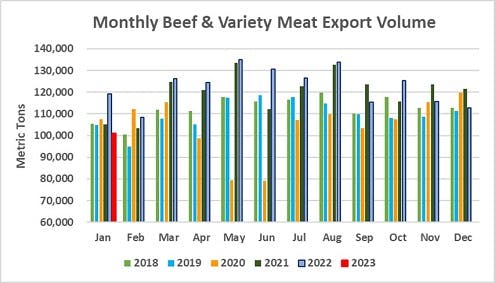

Beef exports declined to several major destinations in January, though shipments increased sharply to Mexico, the Dominican Republic, the Philippines and Africa. January volume fell 15% year-over-year to 100,942 mt, valued at $702.3 million (down 32%).

Beef inventories swelled in some key markets near the end of last year, contributing to a challenging environment for U.S. exports.

“While beef exports are off to a slow start in 2023, we remain optimistic that post-COVID foodservice demand will strengthen in additional markets as the year progresses,” Halstrom said.

Record-large shipments to Mexico lead strong month for pork exports

Fresh off a record year, pork exports to Mexico didn’t miss a beat in January. Export volume was a record 96,800 mt, up 11% from a year ago and 7% above the previous high in December 2022. January export value soared 40% to $191.2 million. Demand for U.S. pork is surging even as it faces increasing competition in Mexico, due to suspension of import duties for all eligible suppliers through the end of 2023. Mexico also recently opened to some imports from Brazil.

Pork exports to the Dominican Republic also remained strong in January, increasing 28% year-over-year to 8,185 mt, while export value jumped 67% to $23.8 million. The DR also suspended import duties from all suppliers for a portion of 2022. But with that decree now expired, the U.S. is the only major supplier with duty-free access at a time when the DR’s domestic production is struggling to overcome the impact of African swine fever (ASF).

While pork production in China has recovered from its ASF-impacted lows, demand is expected to strengthen somewhat in 2023 as importers and consumers respond to the recent removal of COVID-related restrictions and the central and provincial governments implement efforts to revive the economy. In January, pork exports to China/Hong Kong reached 46,315 mt, up 31% from the low year-ago volume, valued at $121.8 million (up 25%).

Other pork export results for January include:

Pork variety meat exports, which set a value record in 2022 at $1.27 billion, maintained a hot pace in January at 47,192 mt, up 34% from a year ago, while value increased 18% to $110.6 million.

Exports to Japan increased 8% from a year ago to 28,476 mt, the highest since September, though export value was down 2% to $115.7 million.

Shipments to Honduras, the largest Central American destination for U.S. pork, climbed 39% from a year ago to 4,430 mt, while value soared 64% to $11.1 million. With demand also trending higher in Guatemala, El Salvador and Nicaragua, exports to the region were up 4% in volume (9,731 mt) and 13% in value ($27.7 million).

Led by growth in the Philippines, exports to the ASEAN region increased 46% to 3,668 mt, valued at $12.1 million (up 58%). In the Philippines, where lower tariffs on imported pork have been extended through the end of 2023, exports totaled 3,052 mt (up 35%), valued at $10.1 million (up 51%). Exports also increased to Vietnam and Singapore.

Exports to Canada, which faces growing challenges in maintaining pork processing capacity, increased 19% from a year ago to 17,972 mt, valued at $67.4 million (up 7%).

January exports equated to $57.81 per head slaughtered, up 8% from a year ago. Exports accounted for 27.2% of total January pork production and 23.4% for muscle cuts only, up from 25.5% and 22.8%, respectively, in January 2022.

Challenging month for beef exports, but bright spots emerge

January beef exports were down substantially in most Asian destinations compared to the large year-ago totals. The decline was especially sharp in South Korea, where volume dipped 36% to 18,896 mt and value fell 52% to $151.5 million. Korea is coming off a record year in which exports set an all-time record value for any single destination, reaching $2.7 billion.

The decline was less pronounced in Japan, where January exports were down 2% to 22,456 mt, with value falling 20% to $144.9 million.

Exports to China/Hong Kong, which also reached new heights in 2022, fell 24% from a year ago to 14,980 mt, valued at $125.3 million. China lifted COVID-related restrictions on residents and travelers late last year and eliminated testing and disinfection of imported cold chain products in January. But these changes came amid a significant wave in COVID cases, which likely delayed any boost in consumer demand.

Beef exports to Mexico showed positive momentum in January, climbing 20% from a year ago to 17,479 mt, valued at $94.7 million – up 19% and the highest in more than a year. U.S. beef could soon face heightened competition in Mexico, as earlier this week Mexican officials finalized import requirements for some imports from Brazil. This will be the first time the country has opened to Brazilian beef.

Other beef export results for January include:

Led by strong growth in the Dominican Republic and the Bahamas, January exports to the Caribbean climbed 26% from a year ago to 2,339 mt, with value up 15% to $19.6 million. Exports also increased to Jamaica, the Netherlands Antilles and Trinidad and Tobago.

The Philippines continues to emerge as a promising destination for U.S. beef, with January exports climbing 73% from a year ago to 1,020 mt, valued at $6 million (up 17%).

Fueled by larger shipments to South Africa, exports to Africa nearly quadrupled last year’s low volume to reach 2,624 mt (up 284%). Export value increased 148% to just over $3 million. After a sluggish 2022, beef variety meat exports to South Africa rebounded strongly to 2,119 mt in January, the highest since April 2021 and the fourth largest monthly total on record. The majority of January exports to South Africa were beef livers.

While total beef exports to South America were fairly steady with last year (1,525 mt, down 1%), variety meat shipments increased sharply in January. Variety meat exports to Colombia jumped 140% from a year ago to 235 mt, valued at $323,000 (up 120%). Exports to Peru climbed 343% to 217 mt, valued at $374,000 (up 119%).

Exports to Taiwan, which were record-large in 2022, took a step back in January, dropping 34% from a year ago to 4,578 mt, valued at $44.3 million (down 47%).

January beef exports equated to $331.27 per head of fed slaughter, down 34% from a year ago. Exports accounted for 12.7% of total January beef production and 10.8% for muscle cuts only. Both were down significantly from the respective year-ago ratios of 15.4% and 13.3%.

Lamb exports open 2023 on high note

January exports of U.S. lamb muscle cuts totaled 222 mt, up 161% from the low year-ago volume, while export value essentially doubled to $1.1 million (up 99%). Growth was led by strong increases to Mexico and the Caribbean, while shipments were also higher to Canada and Guatemala.

Complete January export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).