Momentum Continues for U.S. Pork Exports in February; Beef Exports Below Year-Ago

Slides of January-February 2023 export highlights

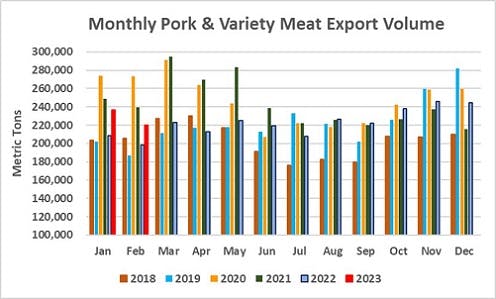

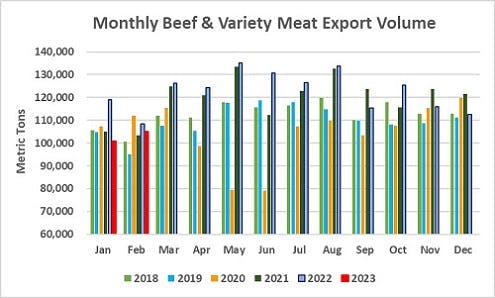

U.S. pork exports remained robust in February, achieving double-digit increases over last year in both volume and value, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Beef exports were lower year-over-year but improved from the low totals posted in January.

February pork exports totaled 219,729 metric tons (mt), up 11% from a year ago, while export value increased 10% to $596 million. This included a particularly strong performance for pork variety meat exports, which jumped 40% to nearly 48,000 mt, valued at $111.8 million – up 25% and the eighth highest on record.

Through February, total pork and pork variety meat exports increased 12% to 456,496 mt, valued at $1.24 billion (up 13%).

“After setting a value record in 2022, the momentum for pork variety meat exports continues this year,” said USMEF President and CEO Dan Halstrom. “While this is largely attributable to a rebound in exports to China, demand is also strengthening in other markets including Mexico and the Philippines. It also reflects an improved labor situation, which has helped the U.S. industry increase its capture rate and broaden the range of destinations for pork variety meats.”

Beef exports totaled 105,057 mt in February, down 3% from a year ago, while export value dropped 16% to $757.8 million. For the first two months of the year, exports were down 9% from last year’s large volume to just under 206,000 mt, while export value dipped 24% to $1.46 billion.

“On the beef side, it was encouraging to see a modest rebound compared to January,” Halstrom said. “With Asian markets continuing to ease indoor mask mandates and eliminate travel restrictions, we expect to see a continued boost in restaurant traffic and foodservice demand as the year progresses.”

Pork to Mexico remains strong; CAFTA and ASEAN regions also trend higher

After a string of record-breaking months, pork exports to Mexico cooled slightly in February but remained well above year-ago levels. February volume reached 78,226 mt, up 6% from a year ago, while value climbed 31% to $154.7 million. This pushed the January-February totals for Mexico 9% ahead of last year’s record pace in volume (175,026 mt) and 36% higher in value ($346 million).

February pork exports to the Dominican Republic more than doubled year-over-year to a record 10,681 mt (up 106%), valued at $27.7 million (up 105%). For the first two months of the year, exports to the DR climbed 63% to 18,866 mt, valued at $51.5 million (up 86%). With exports also trending higher to the Bahamas, Trinidad and Tobago, Leeward-Windward Islands and Netherland Antilles, January-February exports to the Caribbean increased 57% to 21,616 mt, valued at $61.7 million (up 74%).

Fueled by strong growth in the Philippines, Vietnam and Singapore, February pork exports to the ASEAN region totaled 4,229 mt, up 49% year-over-year, valued at $10.9 million (up 43%). Through February, exports to the region increased 48% to 7,897 mt, valued at $23 million (up 50%). U.S. pork’s competitive position has improved in the ASEAN due to reduced tariff rates in the Philippines and Vietnam, along with tighter supplies of European pork.

A strong February performance for pork variety meat exports (see above) pushed January-February shipments 37% above last year’s pace to 95,167 mt, valued at $222.4 million (up 21%). While the increase is largely attributable to strong demand in China-Hong Kong (55,956 mt, up 37%), variety meat exports also trended higher to Mexico, the Philippines, South Korea, the DR, Colombia and Honduras.

Other January-February results for U.S. pork exports include:

Led by strong growth in Honduras, Guatemala, El Salvador, Costa Rica and Nicaragua, February pork exports to Central America increased 14% to 10,753 mt, valued at $29.6 million (up 15%). Shipments to Guatemala and El Salvador were the third largest and fourth largest on record, respectively. Through February, exports to the region increased 9% to 20,484 mt, valued at $57.3 million (up 14%).

Exports to China-Hong Kong increased 32% from a year ago to 90,190 mt, while value climbed 26% to $233.9 million. Although pork variety meat made up more than 60% of this total, muscle cut exports to the region also trended higher in both volume (34,234 mt, up 24%) and value ($88.9 million, up 31%).

After being nearly absent from the Taiwanese market since late 2021 due to negative publicity and burdensome country of origin labeling regulations related to ractopamine, pork exports to Taiwan are showing signs of a rebound in 2023. Through February, exports more than tripled last year’s low totals in volume (944 mt, up 287%) and more than quadrupled in value ($3.4 million, up 367%). As recently as 2020, U.S. pork shipments to Taiwan topped 20,000 mt, valued at $54 million.

Exports to Japan were down 4% year-over-year through February to 57,032 mt, while value slipped 11% to $229.7 million. Chilled pork shipments, which are critical to serving Japan’s high-value retail sector, continue to face shipping delays and uncertainty on the West Coast. The Japanese yen has rebounded from its lows of 150 per U.S. dollar in October, to about 132 in early April. But the yen is still much weaker than the levels seen in February (115) and March (119) of 2022.

February pork export value equated to $59.76 per head slaughtered, up 10% from a year ago, while the January-February average increased 9% to $58.73. Exports accounted for 28.3% of total February pork production and 23.8% for muscle cuts only – up from the year-ago ratios of 25.5% and 22.7%, respectively. For January-February, exports accounted for 27.7% of total production (up from 25.5%) and 23.6% for muscle cuts (up from 22.7%).

Beef export volume steady to Japan and Korea, trends higher to Mexico

February beef exports to Japan edged modestly higher in volume, increasing 1% from a year ago to 23,876 mt, while value fell 19% to $161.7 million. For the first two months of the year, exports to Japan were steady with last year at 46,332 mt, but were down 20% in value to $306.6 million.

Exports to South Korea followed a similar trend, edging slightly higher in February to 19,382 mt (up 2%), but value declined 22% to $153.3 million. Through February, exports to Korea were down sharply from last year’s large totals in both volume (38,278 mt, down 21%) and value ($304.8 million, down 41%).

Beef exports to Mexico continued to build momentum in February, reaching 15,576 mt (up 10% from a year ago) valued at $91.5 million (up 8%). January-February exports totaled 33,055 mt, up 15% from a year ago, while value increased 13% to $186.3 million. This includes a 12% increase in beef variety meat exports to 16,715 mt, valued at $48.2 million (up 21%). The Mexican beef market is set to become more competitive this year, having recently opened to some beef imports from Brazil for the first time. Imports from Brazil will enter Mexico at zero duty through the end of 2023.

Other January-February results for U.S. beef exports include:

Fueled by strong growth in the Dominican Republic, Jamaica, the Bahamas, Netherlands Antilles and Bermuda, beef exports to the Caribbean increased 28% year-over-year through February to 4,712 mt, with value up 20% to $39.3 million. While tourism drives a large portion of Caribbean beef demand, U.S. beef also has a growing presence in the region’s retail sector.

February exports to China-Hong Kong rebounded to some degree from the steep January decline, but were still down 4% from a year ago to 18,931 mt, while export value dipped 10% to $163.4 million. Through February, exports to the region were 14% below last year’s record pace in volume (33,911 mt) and 23% lower in value ($288.7 million).

Following a record performance in 2022, beef exports to Taiwan are off to a slower start this year. Exports through February totaled 9,009 mt, down 26% from a year ago, while export value declined 42% to $85.7 million.

South Africa has reemerged as a major destination for beef variety meat exports, mainly livers and kidneys, after volumes slowed in 2022. Shipments through February more than doubled from a year ago in volume (4,070 mt, up 144% and a record pace) and nearly tripled in value ($4.3 million, up 184%). Through February, South Africa was the second largest destination for U.S. beef liver exports and the largest destination for kidney exports. Variety meat exports are also trending sharply higher this year to Cote D’Ivoire.

Beef exports to the European Union strengthened in February to 1,662 mt, up 59% from a year ago, while value jumped 48% to $20.6 million. This pushed the two-month volume 12% higher to 3,023 mt, valued at $36.1 million (up 6%).

Beef export value equated to $391.71 per head of fed slaughter in February, down 12% from a year ago, while the January-February average was down 24% to $360.20 per head. Exports accounted for 14.6% of total beef production in February, up one-half percentage point from a year ago, while the percentage of muscle cuts exported was 12.4% (up from 11.6%). Through February, these ratios were 13.6% of total production and 11.6% for muscle cuts, each down about one percentage point from a year ago.

Lamb exports continue to trend higher

Exports of U.S. lamb muscle cuts totaled 224 mt in February, up 26% from a year ago, while value increased slightly to $1.23 million. Led by growth in Mexico, the Netherlands Antilles, the Turks and Caicos Islands and Guatemala, January-February exports increased 70% to 446 mt, while value was up 31% to $2.33 million.

Complete January-February export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

One metric ton (mt) = 2,204.622 pounds.

As noted the past several months, USMEF has raised concerns in recent years with USDA about export data collected by the Department of Commerce for lamb variety meat to Mexico. Reported volumes have declined dramatically since July, suggesting that the data reported in prior months and years were disproportionately high. USMEF is therefore focusing year-over-year comparisons on lamb muscle cuts only.

U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place).