August Beef Exports Top $1 Billion; Pork Exports Remain on Record Pace

U.S. beef exports soared to another new value record in August, topping the $1 billion mark for the first time, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Pork exports posted another strong month in August, remaining ahead of the record pace established in 2020.

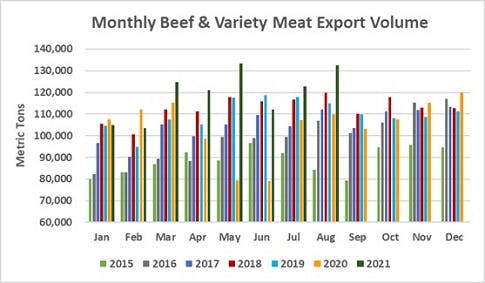

August beef exports totaled 132,577 metric tons (mt), up 21% from a year ago and the second largest volume this year, while export value climbed 55% to $1.04 billion. For January through August, beef exports increased 18% from a year ago to 955,407 mt, with value up 34% to $6.62 billion. Exports were also 6% higher in volume and up 20% in value compared to the record pace established in 2018.

Pork exports totaled 225,822 mt in August, up 4% from a year ago, and value increased 20% to $633.9 million as record shipments to Mexico and strong growth in several other markets helped offset the expected slowdown in muscle cut exports to China. For January through August, exports were 1.5% above last year at just over 2 million mt, while value climbed 10% to $5.62 billion.

"The August export results would be impressive under any circumstances, but achieving these totals despite all the COVID-related obstacles at home and overseas is truly remarkable," said USMEF President and CEO Dan Halstrom. "Our transportation and labor situation is challenging, and customers continue to face an uncertain business climate due to foodservice restrictions and other economic headwinds. Yet international buyers remain committed to the quality and consistency delivered by U.S. red meat, and the U.S. industry has gone to tremendous lengths to keep shipments moving."

Halstrom emphasized the broad-based growth achieved in 2021, noting that it bodes well for both near and long-term exports.

"Obviously breaking the $1 billion mark in a single month is a huge milestone for U.S. beef, and that's not possible unless a wide range of markets are hitting on all cylinders," he said. "But the trendlines for U.S. pork are also very encouraging. Just a few years ago, it was an achievement to reach $6 billion in pork export value in a full year. In 2021, exports will exceed that total with an entire quarter to spare."

Surge in demand from China helps fuel huge month for U.S. beef exports

Beef exports to China have climbed steadily since early 2020, when market access barriers were greatly reduced under the U.S.-China Phase One Economic and Trade Agreement. August marked the best performance to date, with exports topping 20,000 mt for the first time and value reaching $182.2 million (both volume and value were more than five times the year-ago totals). Through August, exports to China increased more than 800% from a year ago in both volume (119,685 mt) and value ($955.2 million), with U.S. beef accounting for 5.6% of China’s imports (up from less than 1% last year). Combined exports to China/Hong Kong climbed 139% year-over-year to 154,353 mt, while value reached $1.28 billion (up 148%).

August beef exports to Japan were the largest of the year at 31,573 mt, up 21% from a year ago, while value soared 79% to $233.6 million. For January through August, exports to Japan pulled 3% ahead of last year's pace at 216,409 mt. Export value was up 14% to $1.51 billion, as Japan edged slightly ahead of South Korea as this year's largest value destination for U.S. beef. Japan has been importing more chilled U.S. beef (up 13% through August) to help meet strong retail demand and to minimize shipping delays, with the U.S. share of Japan’s chilled imports climbing to 52.5% (up from 47.6% a year ago).

Beef exports to Korea were down 11% from last August's large volume at 24,294 mt, but export value still increased 18% to $216.9 million – the second largest total on record, trailing only May 2021. Through August, exports to Korea are on a record pace at 189,963 mt, up 13% from a year ago, while export value jumped 28% to $1.51 billion. Korea has also been importing record volumes of chilled U.S. beef, up 26% through August, with the U.S. capturing 66.3% of Korea’s chilled imported beef market (up from 64% last year). With the strong performance from Japan and Korea and further momentum expected as foodservice restrictions ease, the U.S. beef industry is on track to have two $2 billion export markets for the first time in 2021.

Other January-August highlights for U.S. beef exports include:

- Beef exports to Mexico continue to post a strong recovery, with August exports increasing 37% from a year ago to 16,908 mt and value more than doubling to $104.8 million (up 108%). Through August, exports to Mexico increased 17% from last year's low total to 132,097 mt, while value jumped 38% to $679.1 million. Mexico is the largest volume destination for U.S. beef variety meat, with exports through August reaching 62,844 mt (up 11%) valued at $164.9 million (up 18%).

- Beef demand in Central America has also rebounded in 2021, with January-August shipments on a record pace at 13,173 mt (up 59%), while value soared 82% to $79.2 million. Exports achieved strong growth in leading destination Guatemala and nearly doubled to Costa Rica, while also increasing sharply to Panama, Honduras, El Salvador and Nicaragua.

- August beef exports to Taiwan were 13% below last year's record volume but still the third largest on record at 6,460 mt. August exports posted a double-digit increase in value, climbing 11% to $70.8 million. Through August, exports to Taiwan were 2% below last year's record pace at 41,636 mt but value increased 13% to $412.1 million.

- With a strong rebound in Colombia and solid growth in Chile and Peru, beef exports to South America increased 23% from a year ago to 19,383 mt, valued at $98.8 million (up 59%). Led by Peru, beef variety meat exports to the region were 15% higher at 9,619 mt and jumped impressively in value ($15.7 million, up 48%).

- August beef export value equated to a record $468.75 per head of fed slaughter, up 55% from a year ago. Through August, export value was $381.91 per head, up 28%. Exports accounted for 16.4% of total August beef production and 14.2% for muscle cuts, each up more than two percentage points from a year ago. Through August, exports accounted for 15% of total beef production (up from 13.3%) and 12.8% for muscle cuts (up from 11.1%).

Record exports to Mexico, variety meat demand in China drive strong pork results

August pork exports to Mexico were record-large at 80,779 mt, up 47% from a year ago and narrowly outpacing the previous record set in December 2016). Export value more than doubled to $162.4 million (up 109%). Through August, exports to Mexico were 25% above last year at 543,550 mt, with value climbing 56% to $1.1 billion. Exports are on a record pace, with January-August shipments 4% higher in volume and 12% higher in value when compared to 2017, the peak year for pork exports to Mexico.

While China's swine herd recovery has caused pork muscle cut exports to moderate in 2021, China's demand for U.S. pork variety meat remains extremely strong and continues to play a key role in maximizing carcass value. Through August, pork variety meat exports to China/Hong Kong increased 23% to 231,283 mt, valued at $558 million (up 29%). With pork variety meat shipments also trending higher to Mexico, Southeast Asia, Central and South America and Oceania, export value is on a record pace at $848.8 million, up 26% from a year ago and 11% ahead of the peak year of 2017.

Following a record performance in 2020, pork exports to Central America continue to reach new heights. August exports totaled 10,446 mt, up 35% from a year ago, while value increased 71% to $28.7 million. January-August exports increased to all markets in the region, led by outstanding growth in Guatemala, Honduras, Nicaragua, Costa Rica and El Salvador. Through August, exports climbed 46% from a year ago to 87,437 mt, valued at $232.1 million (up 60%).

Other January-August highlights for U.S. pork exports include:

- Pork exports to Japan trended higher in August (32,837 mt, up 9%), with value climbing 16% to $143.7 million. Through August, exports to Japan were 7% ahead of last year's pace at 271,880 mt, valued at $1.15 billion (up 8%). Japan’s imports of U.S. chilled pork were up 6% from a year ago, totaling 140,900 mt.

- Following a down year in 2020, pork exports to Colombia continue to stage a strong rebound. January-August exports increased 53% from a year ago to 90,674 mt, with value up 67% to $149 million. Compared to the pre-COVID levels of 2019, exports to Colombia were still 5% lower in volume but achieved 3% growth in value.

- Although down from recent months, August pork exports to South Korea were still 10% higher than a year ago at 9,872 mt, while value increased 40% to $36.4 million. Fueled in part by strong demand for chilled pork, January-August exports to Korea increased 6% from a year ago to 119,679 mt, with value climbing 20% to $388.1 million. Korea’s imports of U.S. chilled pork totaled 6,635 mt through August, up 195% from a year ago.

- Pork demand continues to build momentum in the Dominican Republic, where recent findings of African swine fever are impacting domestic production. August exports nearly doubled to 4,884 mt, with value jumping 140% to $13.9 million. This pushed January-August exports 44% above last year at 38,226 mt, valued at $97.1 million (up 62% from a year ago and 30% above the record pace of 2018).

- August pork export value equated to $59.74 per head slaughtered, up 26% from a year ago. Through August, per-head export value averaged $66.14, up 11%. Exports accounted for 28.3% of total August pork production and 24.3% for muscle cuts, up from 25.9% and 23.1%, respectively, in August 2020. Through August, exports accounted for 30.9% of total production, up from 30% in 2020, while the ratio of muscle cuts exported remained steady at 27.3%.

August lamb exports trend lower, but muscle cuts increase

August exports of U.S. lamb were 32% below last year at 1,015 mt, while value slipped 2% to $1.62 million. But muscle cut exports increased significantly from last year's low total, reaching 193 mt, led by growth in Mexico, the Caribbean and Central America.

Through August, lamb exports remained 5% above last year's pace at 8,997 mt, with value up 8% to $12.4 million. Muscle cut exports were 10% higher in both volume (855 mt) and value ($5.1 million).

Complete January-August export results for U.S. pork, beef and lamb are available from USMEF's statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork currently faces retaliatory duties in China. China's duty rate on frozen pork muscle cuts and variety meat increased from 12% to 37% in April 2018, from 37% to 62% in July 2018 and from 62% to 72% on Sept. 1, 2019. The rate on pork cuts was reduced to 68% on Jan. 1, 2020, through a reduction in the most-favored-nation (MFN) rate and to 63% on Feb. 14, 2020, through a reduction in the Section 301 retaliatory duty. The duty on pork variety meat was reduced to 67% on Feb. 14.

- U.S. beef faces retaliatory duties in China. China's duty rate on beef muscle cuts and variety meats increased from 12% to 37% in July 2018 and from 37% to 47% on Sept. 1, 2019. It was reduced to 42% on Feb. 14, 2020.

- In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 33% for muscle cuts and 37% for pork offal (the 25% Section 232 retaliatory duty on U.S. pork remains). Some importers reported receiving duty relief beginning on March 2, 2020.

- Mexico's duty rate on pork muscle cuts increased from zero to 10% in June 2018 and jumped to 20% the following month. Beginning in June 2018, Mexico also imposed a 15% duty on sausages and a 20% duty on some prepared hams. Mexico removed all duties in late May 2019.