USMEF-Mexico Implements Pork Demand Development Program

Published: Jun 17, 2011

Mexico is the No. 1 volume market for U.S. pork exports, which account for 91 percent of all pork imported into Mexico. To the untrained eye, Mexico would appear to be a saturated or “mature” market. That’s not the case, which is why USMEF-Mexico is gearing up for an intense “demand development” program for our neighbors to the South.

As Mexico began to emerge from the global economic downturn, 2010 developed as an outstanding year for U.S. pork exports, which grew by 8 percent in volume to 545,732 metric tons (1.2 billion pounds) valued at nearly $987 million, a 29 percent jump.

So, if the U.S. already is selling more than one out of every four pounds of pork it exports to Mexico (28.4 percent), where is the opportunity?

“Per capita consumption of pork in Mexico is comparatively low at 30.8 pounds per year, and that total has remained flat for the past six years,” said Chad Russell, USMEF regional director for Mexico, Dominican Republic and Central America. “Comparable figures for Canada, the United States and China are 50.6 pounds, 66 pounds and 77 pounds, respectively.”

Russell also noted that as a percentage of meat consumed in Mexico, pork has declined in recent years. An important element of that decline has been the misinformation consumers often receive about pork. Correcting inaccurate perceptions is a core part of the USMEF program.

Another pillar of the program is helping consumers – many of whom do not regularly buy pork – to better understand its versatility and how to prepare it.

“We will use consumer-tested messages to create an emotional response,” said Russell. “It is easy to prepare, it is delicious, it is nutritious and my family will love it.”

The USMEF pork education and imaging initiative will combine accurate and informative messaging with demographic details that will help USMEF target the regions and groups that seem most receptive. Consumer attitudes are being assessed on an ongoing basis through focus groups, and results will be measured in sales.

“Misperceptions about pork, regardless of its origin, include concerns about health, fat content and associations with disease,” said Russell. “USMEF is using this opportunity to provide accurate information to help consumers better appreciate the benefits and safety of pork that is properly produced, handled and prepared.”

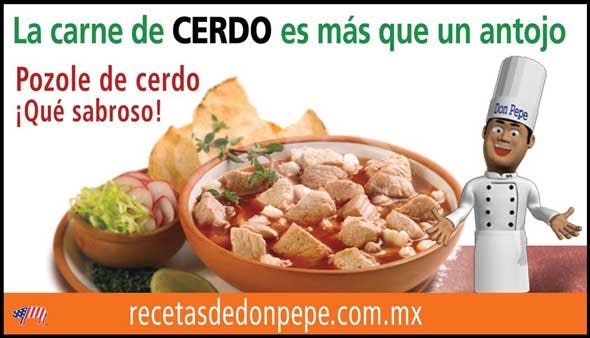

The USMEF program will reach consumers through a variety of media, including point of sale, Internet, social media, television, radio and billboards. Internet-based recipes on how to prepare easy, healthy pork-centric meals is a key element of the strategy. Homemakers between the ages of 25 and 45 in Mexico City, Guadalajara, Monterrey and several other small but strategic cities will be the primary targets.

“Everyone benefits from a positive perception of pork in Mexico,” said Russell. “U.S. pork is heavily utilized by Mexico’s processing industry and is well-received by Mexican consumers. If we can help increase per capita consumption to levels closer to the North American average, the U.S. pork industry is well-positioned to participate in that growth.”

So, if the U.S. already is selling more than one out of every four pounds of pork it exports to Mexico (28.4 percent), where is the opportunity?

“Per capita consumption of pork in Mexico is comparatively low at 30.8 pounds per year, and that total has remained flat for the past six years,” said Chad Russell, USMEF regional director for Mexico, Dominican Republic and Central America. “Comparable figures for Canada, the United States and China are 50.6 pounds, 66 pounds and 77 pounds, respectively.”

Russell also noted that as a percentage of meat consumed in Mexico, pork has declined in recent years. An important element of that decline has been the misinformation consumers often receive about pork. Correcting inaccurate perceptions is a core part of the USMEF program.

Another pillar of the program is helping consumers – many of whom do not regularly buy pork – to better understand its versatility and how to prepare it.

“We will use consumer-tested messages to create an emotional response,” said Russell. “It is easy to prepare, it is delicious, it is nutritious and my family will love it.”

The USMEF pork education and imaging initiative will combine accurate and informative messaging with demographic details that will help USMEF target the regions and groups that seem most receptive. Consumer attitudes are being assessed on an ongoing basis through focus groups, and results will be measured in sales.

“Misperceptions about pork, regardless of its origin, include concerns about health, fat content and associations with disease,” said Russell. “USMEF is using this opportunity to provide accurate information to help consumers better appreciate the benefits and safety of pork that is properly produced, handled and prepared.”

The USMEF program will reach consumers through a variety of media, including point of sale, Internet, social media, television, radio and billboards. Internet-based recipes on how to prepare easy, healthy pork-centric meals is a key element of the strategy. Homemakers between the ages of 25 and 45 in Mexico City, Guadalajara, Monterrey and several other small but strategic cities will be the primary targets.

“Everyone benefits from a positive perception of pork in Mexico,” said Russell. “U.S. pork is heavily utilized by Mexico’s processing industry and is well-received by Mexican consumers. If we can help increase per capita consumption to levels closer to the North American average, the U.S. pork industry is well-positioned to participate in that growth.”

Despite the large volumes of pork that the U.S. sells to Mexico, the country still has a prominent domestic pork industry accounting for about two-thirds of its consumption. That being said, its self-sufficiency ratio has declined over time. At the same time, feed stocks (corn and soy), the primary production cost factors for hogs, are imported at higher costs than in the United States. And, in recent years, Mexico’s domestic pork production has not kept pace with consumption – a trend that USMEF believes will continue into the foreseeable future.

“Mexico is increasingly dependent on imports of pork to meet the needs of its large, dynamic meat processing industry and consumer demand for quality, competitively priced meat protein,” said Russell. “The U.S. is uniquely positioned – through geography and our ability to produce a high-quality product at an attractive price – to fill that need.”

“Mexico is increasingly dependent on imports of pork to meet the needs of its large, dynamic meat processing industry and consumer demand for quality, competitively priced meat protein,” said Russell. “The U.S. is uniquely positioned – through geography and our ability to produce a high-quality product at an attractive price – to fill that need.”